An Overview of GCC Payment Gateways

The Gulf Cooperation Council (GCC) is a region experiencing significant growth in online business transactions. E-commerce continues to gain popularity rapidly in the Middle East and North Africa (MENA) region. Businesses are increasingly adopting online payments, both from customers and fellow businesses. Due to this, payment gateways have become an essential tool in the GCC region. A payment gateway is a service that allows businesses to accept online payments securely and efficiently, making it an indispensable tool for e-commerce businesses in the MENA region. However, with the many payment gateway options available, it can be challenging for companies to choose the right payment gateway that meets their unique needs. In this post, we will provide a quick guide to payment gateways in the GCC and discuss the challenges they face in the region. We will also help you choose the best payment gateway for your business in the GCC and highlight why PayTabs is an excellent option.

What are Payment Gateways

A payment gateway is an online platform that facilitates transactions between merchants and customers by securely processing payments from a customer’s bank account to the merchant’s account. Payment gateways act as a link between the merchant’s website and the bank, providing a secure way for customers to pay for products or services online.

Payment Gateways, Payment Processors, and Payment Aggregators

● Payment Gateway

A payment gateway is an online platform that acts as a secure intermediary between the merchant and the customer’s bank. It handles the transmission of transaction data between the merchant and the customer’s bank, ensuring the process is secure and successful. Payment gateways typically offer a range of payment methods and are responsible for verifying the transaction’s validity.

● Payment Processor

A payment processor is a company that processes credit and debit card transactions on behalf of merchants. Payment processors are responsible for receiving and verifying payment details from the payment gateway, communicating with the card networks to authorize transactions, and settling funds to the merchant’s account. Payment processors may also offer additional services such as chargeback management and fraud detection.

Also Read: What are the Benefits of Working with a Payment Processor?

● Payment Aggregator

A payment aggregator is a company that allows merchants to accept payments through multiple payment methods without having to establish separate merchant accounts for each payment method. Payment aggregators typically pool transactions from multiple merchants into a single merchant account, making it easier for smaller businesses to accept payments without needing multiple merchant accounts. They may also offer additional services such as fraud detection and chargeback management.

Payment Gateway Challenges in the GCC

The GCC region faces several challenges when it comes to payment gateways. Some of these challenges are:

● Lack of a Unified Payment System

Each country in the GCC has its own payment infrastructure, making it challenging for payment gateways to operate seamlessly across all GCC countries. This lack of uniformity can lead to transaction processing delays and higher business costs.

● High Levels of Fraud

The GCC region is a hub for international business, which attracts many fraudulent activities. These activities can range from using stolen credit cards to identity theft, which can cause significant financial losses to businesses. To counter this, payment gateways have to implement robust security measures, such as two-factor authentication and advanced fraud detection systems. However, these measures can increase the cost of transaction processing, which can impact the profitability of businesses.

● Limited Availability of Payment Methods

One of the biggest challenges is the unavailability of different payment methods for businesses as well as consumers. While debit and credit cards are widely used in the GCC, other payment methods, such as e-wallets and cryptocurrencies, are not as widely adopted. This limited availability of payment methods can make it challenging for businesses to cater to the needs of all their customers, resulting in lost sales opportunities.

● Regulatory Challenges

The GCC region has strict regulations around online payments and financial transactions, and payment gateways must comply with these regulations to operate in the region. This can result in additional costs and time for payment gateway providers to meet regulatory requirements, impacting the speed and efficiency of transaction processing.

Choosing the Best Payment Gateway for GCC

When selecting the best payment gateway for the GCC region, several factors must be considered to ensure that the payment gateway meets the needs of your business and customers.

- Payment Methods: It is essential to choose a payment gateway that supports a variety of payment methods that are popular in the GCC region. This includes credit and debit cards, mobile payments, and e-wallets. Offering a range of payment options can help increase customer satisfaction and boost sales.

- Security: With the high levels of fraud in the GCC region, choosing a payment gateway that offers advanced security features, such as two-factor authentication and tokenization, is critical. Look for a payment gateway that is PCI-DSS compliant, as this ensures that the gateway has implemented the necessary security measures to protect sensitive customer information.

- Integration: Choose a payment gateway that seamlessly integrates with your website or e-commerce platform. The payment gateway should be easy to set up, and the integration should be straightforward, so you can start accepting payments quickly.

- Transaction Fees: The transaction fees charged by payment gateways can vary significantly, and choosing a payment gateway that offers competitive rates is essential. Consider the per-transaction fee, monthly fees, and any other charges that may apply.

- Customer Support: When it comes to payment processing, downtime and technical issues can impact your business’s revenue. Choose a payment gateway that offers reliable support, with responsive customer service agents available to assist with any issues that may arise.

- Localization: Look for payment gateways catering specifically to the GCC region. These payment gateways may offer features such as multi-currency support and local payment methods, making it easier to do business in the region.

- Reputation: Choose a payment gateway with a good reputation in the industry. Look for payment gateways that have been in business for several years and have a track record of providing secure and reliable payment processing services.

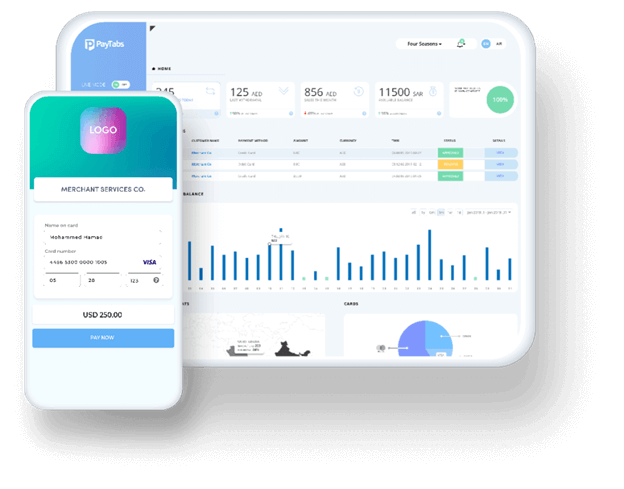

Why Choose PayTabs as Your Payment Gateway?

PayTabs is a leading payment gateway provider in the GCC region, offering a range of payment processing services specifically tailored to the needs of businesses in the region. Certain reasons why you should choose PayTabs as your payment gateway are listed below:

- Localized Payment Solutions: PayTabs offers localized payment solutions that support a range of payment methods, such as mobile payments, credit and debit cards, and e-wallets that are popular in the GCC region. This helps businesses to cater to their customers’ payment preferences, boosting customer satisfaction and increasing sales.

- Advanced Security Features: This payment gateway implements advanced security features, including PCI-DSS compliance, two-factor authentication, and tokenization, to ensure secure payment processing and protect sensitive customer information. This helps businesses to build trust with their customers and prevent scams.

- Seamless Integration: PayTabs provides a range of integration options, including plug-ins for popular e-commerce platforms and APIs for custom integration, making it easy for businesses to integrate their payment gateway with their website or app.

- Competitive Pricing: PayTabs offers competitive pricing with no hidden fees, ensuring that businesses can keep their payment processing costs under control. With PayTabs, companies can enjoy transparent pricing and flexible payment plans.

- Responsive Customer Support: This payment gateway offers 24/7 customer support to assist companies with any technical issues or queries they may have. Their responsive customer support team is available via email, phone, or live chat, ensuring that businesses can get the requisite support when they need it.

Conclusion

Payment gateways play a crucial role in facilitating online transactions in the GCC region. When choosing a payment gateway, it’s essential to consider factors such as payment methods, transaction fees, and security features. PayTabs is an excellent option for businesses operating in the GCC region, with its support for multiple payment methods, competitive transaction fees, and robust security features.