ChatGPT: Transforming the Payments Industry in 2023

Artificial intelligence, or AI, has significantly transformed various industries in recent years. One area where AI has proven to be a game-changer is in the payments industry. ChatGPT, a language model developed by OpenAI, is one such AI-powered tool that has revolutionized the way businesses interact with their customers. ChatGPT has made significant advancements in natural language understanding and generation, allowing it to handle a wide range of conversational scenarios. It has the potential to transform various industries, including the payments sector, by providing interactive and personalized experiences to users, automating routine tasks, and assisting with complex financial inquiries. Here we will explore the impact of ChatGPT on the payments industry, highlighting its potential benefits, use cases, and some challenges in implementation.

What is ChatGPT?

ChatGPT, an advanced language model, has been developed by OpenAI. It is built on the GPT or Generative Pre-trained Transformer architecture, a deep learning model designed to generate human-like text based on the patterns it has learned from vast amounts of training data. The model has been trained on various text sources from the internet, enabling it to understand and respond to a wide array of topics and queries. Through its training, ChatGPT has learned to generate coherent and contextually relevant responses, making it capable of simulating human-like conversation.

ChatGPT employs a transformer architecture, which allows it to capture long-range dependencies in text and generate highly contextualized responses. It utilizes a combination of attention mechanisms and deep neural networks to process and understand the input text, generating contextually relevant and linguistically coherent responses. To interact with ChatGPT, users provide textual inputs in the form of messages or queries, and the model responds with text-based replies. The model takes into account the entire conversation history, ensuring continuity and context awareness in its responses.

Impact of ChatGPT on the Payments Industry

Enhanced Customer Experience

ChatGPT has significantly improved customer experiences in the payments industry. By integrating ChatGPT into their payment systems, businesses can offer personalized and real-time support to their customers. Users can inquire about transaction details and payment options, resolve issues, and receive tailored recommendations seamlessly. This level of interactive and conversational customer service enhances customer satisfaction and loyalty, fostering stronger relationships between businesses and their clients.

Efficient Query Handling

Traditional payment systems often require customers to navigate complex menus or wait for customer service representatives to address their queries. ChatGPT streamlines this process by offering instant and accurate responses to common payment-related questions. Customers can quickly get information about transaction statuses, payment history, account balances, and payment options. It saves time for both customers and businesses, ensuring a smoother payment experience and reducing customer frustration.

Automation of Routine Tasks

ChatGPT’s ability to complete tasks on behalf of users has simplified payment processes. Businesses can leverage ChatGPT to automate routine tasks such as bill payments, fund transfers, and account management. Users can initiate transactions and execute payment instructions through natural language conversations with the AI-powered system. This automation reduces manual efforts, minimizes errors, and increases overall efficiency. It also frees up human resources to focus on more complex and strategic aspects of the payment operations.

Fraud Detection and Prevention

Fraudulent activities pose significant challenges to the payments industry, leading to financial losses and damage to the reputation of businesses. ChatGPT can play a vital role in fraud detection and prevention. By continuously analyzing customer interactions, ChatGPT can identify suspicious patterns, detect potential fraud attempts, and alert businesses to potential risks. This helps mitigate fraud, safeguard customer data, and protect financial transactions. With its ability to process vast amounts of data in real-time, ChatGPT can effectively detect anomalies and flag suspicious activities, enhancing the security of payment systems.

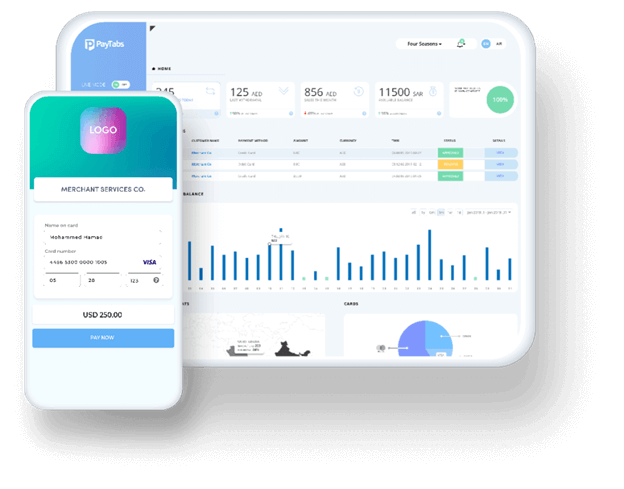

Seamless Cross-platform Integration

ChatGPT can seamlessly integrate with various payment platforms and channels, including mobile apps, websites, and messaging applications. This flexibility allows businesses to offer consistent and unified customer experiences across different touchpoints. Customers can initiate payments, resolve issues, and receive support seamlessly regardless of the platform they choose to engage with. This multi-channel integration enhances convenience and accessibility, catering to the preferences and needs of diverse customer segments.

Data-driven Insights

ChatGPT can generate valuable insights from customer interactions and conversations. Businesses can gain a deeper understanding of customer behavior, preferences, and pain points by analyzing user queries, feedback, and transactional data. These insights can inform decision-making processes, allowing businesses to optimize their payment systems, improve customer satisfaction, and identify opportunities for innovation and growth.

Use-Cases of ChatGPT in the Payments Industry

Loan Origination

ChatGPT can streamline the loan origination process by providing personalized assistance to customers. It can guide users through the application process and answer questions about eligibility criteria, documentation requirements, and loan terms. ChatGPT can also assess customer financial data, analyze creditworthiness, and provide instant pre-approval decisions, expediting the loan application process and improving customer satisfaction.

Virtual Assistants for Banks

ChatGPT can be deployed as virtual assistants for banks, offering round-the-clock support to customers. Virtual assistants powered by ChatGPT can handle routine customer queries, provide account information, assist with transaction history inquiries, and guide users through payment processes. They can also offer product recommendations, address security concerns, and provide personalized financial advice, enhancing customer engagement and loyalty.

Risk Management

ChatGPT can play a significant role in risk management within the payments industry. By analyzing transactional data and customer interactions, ChatGPT can identify potential fraudulent activities, suspicious patterns, and anomalies in real-time. It can alert risk management teams, enabling them to take immediate action to prevent financial losses. ChatGPT can also assist in identifying potential credit risks and predicting default probabilities, aiding in proactive risk mitigation strategies.

Customer Onboarding

ChatGPT can simplify the customer onboarding process by guiding new customers through the account setup and verification procedures. It can assist in collecting necessary information, verifying identities, and ensuring compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. ChatGPT can also educate customers about security measures and promote awareness of potential fraud risks during the onboarding process.

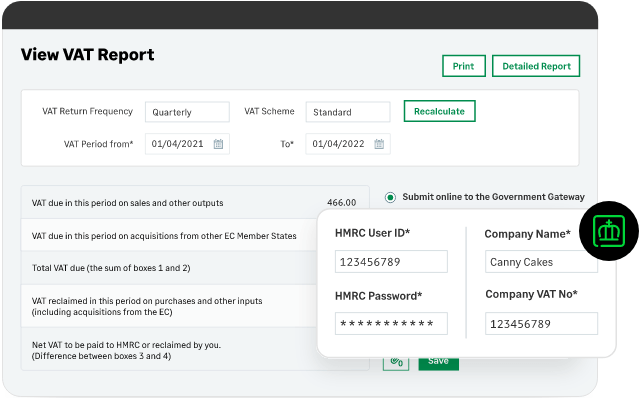

Compliance, KYC, and AML

Compliance with regulatory standards is a crucial aspect of the payments industry. ChatGPT can assist in ensuring compliance by performing real-time checks and validations. It can help verify customer identities, authenticate transactions, and identify any suspicious activities that may indicate money laundering or other fraudulent behavior. ChatGPT can also explain and guide compliance requirements, helping businesses stay updated with the ever-changing regulatory landscape.

Financial Planning

ChatGPT can serve as a virtual financial planner, helping customers make informed decisions regarding their finances. It can provide personalized recommendations based on individual financial goals, risk tolerance, and investment preferences. ChatGPT can assist with budgeting, debt management, savings strategies, and investment advice, empowering customers to make sound financial choices and achieve their financial objectives.

Challenges of Implementing ChatGPT in the Payments Industry

- Security and Privacy Concerns: As ChatGPT handles sensitive financial information, ensuring the security and privacy of customer data is paramount. Robust encryption protocols and stringent data protection measures must be in place to prevent data breaches and unauthorized access.

- Regulatory Compliance: The payments industry is subject to strict regulations and compliance standards. Implementing ChatGPT necessitates adherence to these regulations, including those pertaining to data privacy, AML, KYC, and fraud prevention. Businesses must ensure that ChatGPT aligns with these requirements.

- Handling Complex Queries: While ChatGPT excels at answering routine queries, it may struggle with more complex or nuanced questions. Training the model to handle a wide range of scenarios and adapting it to industry-specific jargon and contexts may pose challenges, requiring ongoing refinement and fine-tuning.

Conclusion

ChatGPT helping the payments industry, has revolutionized the way businesses interact with their customers. With enhanced customer experiences, efficient query handling, task automation, fraud detection capabilities, seamless integration with payment gateways, and data-driven insights, ChatGPT offers immense value to businesses seeking to improve their payment systems. However, challenges related to security, privacy, regulatory compliance, and handling complex queries must be carefully addressed to ensure a seamless and secure implementation. As AI technology continues to evolve, the payments industry can expect even more sophisticated AI-driven solutions that enhance convenience, security, and efficiency in payment processes, ultimately reshaping the landscape of payment gateways.