PayTabs Touch

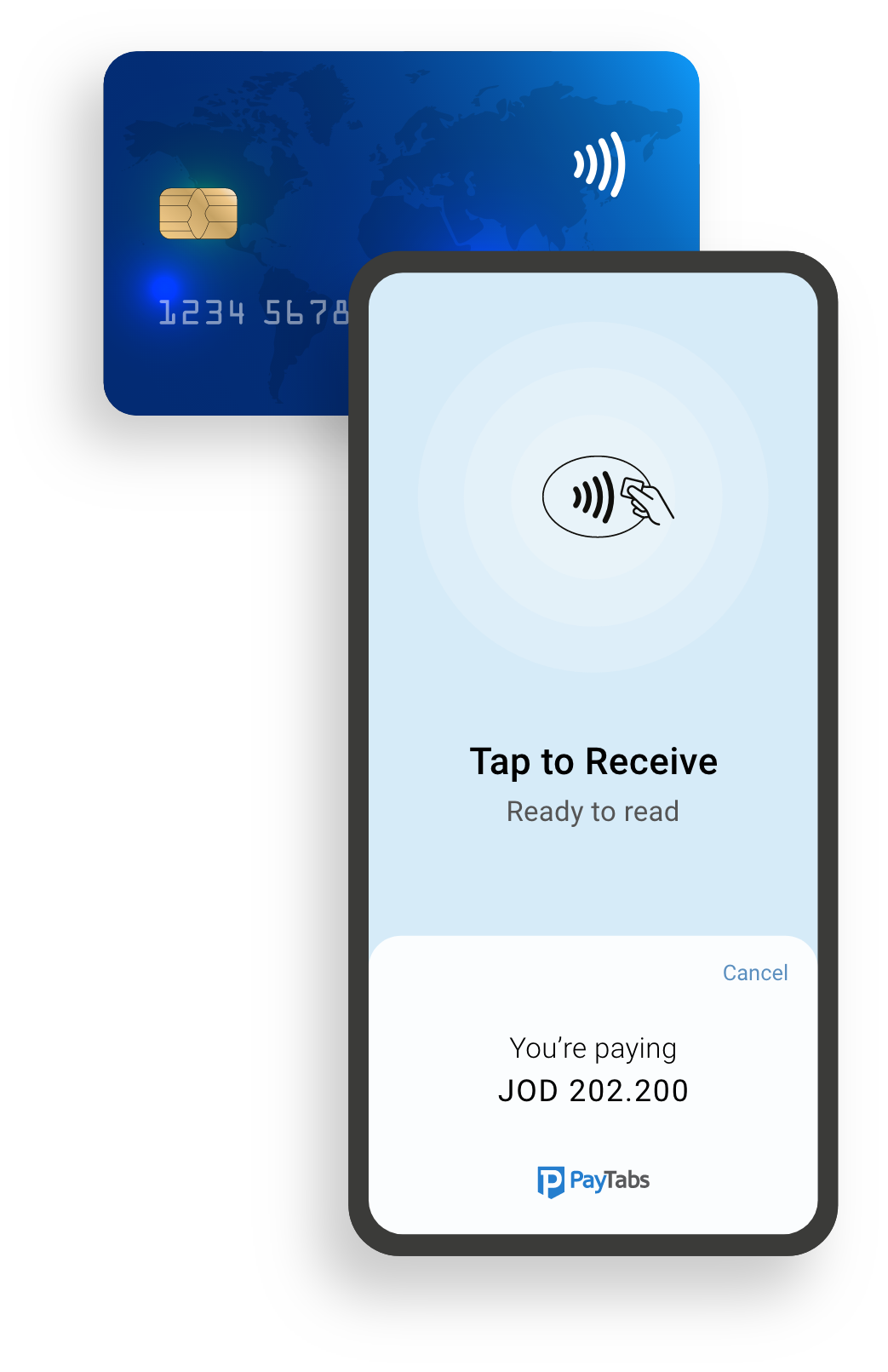

Introducing the first soft POS solution in the MENA market to transform smart phones into merchant point of sale (POS) terminals.

How does it work?

All you need to know as a merchant

Accept payments

PT Touch will enable you to accept payments using contactless cards or wallets via an app on your Android smartphones with NFC

Connectivity

This device independent solution will require you to have a mobile number with a Wi-Fi or mobile data connection – it’s that simple!

#TaptoPay

Supported cards include Visa and MasterCard branded Cards and Digital Wallets

Processed thru PayTabs

Payment processing is then performed through the PayTabs Touch Terminal Management Server.

Secured payments

A fully secured and compliant technology - PT Touch provides all protective mechanisms to satisfy VISA/Mastercard security requirements for your added peace of mind

Benefits to Merchants: Your phone becomes your business hub

The mobile application does not require additional hardware to work

Once downloaded, the Mobile application is always available

Registration and activation can be completed in three clicks

Merchants can view transaction history

Banks can benefit from:

Simplified merchant service logistics

No security key management costs

Improved merchant monitoring mechanisms

Website Terms and Conditions

New opportunities to attract merchants from various segments

Registration automation

Application usage history monitoring

The ability to turn off the merchant app automatically if any security violation is detected

With the PayTabs soft POS touchscreen solution, and in response to evolving lifestyles, consumerism, and the rapid growth in e-tailing, millions of merchants can now rely solely on contactless software-based solutions for payments. PT Touch aims to render traditional, expensive, location-centric devices like physical POS devices and terminals obsolete.

The current landscape highlights a growing consumer preference for digital payments, driven by the convenience of contactless transactions, especially during lockdowns. Surveys suggest that digital payments in the GCC and MENA regions will surge, fueled by smartphone penetration, projected to reach approximately 91% by 2025.