Get Onboarded with Just Your Freelancer Certificate

Over the last 36 months, the world has seen significant changes in the way we work. Technological shifts, 4-day workweeks and the rise in remote work have led to an increase in people wanting to move away from the traditional cubicles and work from wherever they want.

As per The World Bank, nearly 47% of all the employees working worldwide are freelancers or self-employed. It has become easier for people to travel the world and keep earning to support their lifestyle.

While freelancers might not have a concrete office to work out of, they are still employees subjected to their country’s rules and regulations. For people wanting to freelance in the UAE or looking to move to the Kingdom of Saudi Arabia, it’s important to be aware of the requirements allowing them to work legally. If you’re not compliant, not only will you have trouble finding clients, you won’t be able to accept payments in your local account.

In this article, we’ll take a look at the requirements needed to work as a freelancer in Middle Eastern countries and how PayTabs can help you with the onboarding process.

Freelancing in the UAE

The rise of digital platforms and a helping hand from the government to promote a knowledge-based economy has helped freelancing gain popularity in the UAE. Freelancers can either obtain a freelance permit from the Dubai Economic Department (DED) or work with various free zones without any hassle.

However, it’s important to note that each Emirate may have different regulations, so it’ll be better to research the one you want to work in.

Dubai Economic Department (DED) Freelance Permit

The DED offers a permit for individuals wanting to freelance across various sectors. The permit must be renewed annually and is usually issued for a specific activity. An individual would require proof of professional qualifications or experience, a no-objection letter from the current sponsor, and a business plan outlining their services.

You should consult legal experts and relevant authorities to understand the requirements, fees, and documentation needed to obtain the freelance permit.

Freelance Permits in Free Zone

Several free zones in the UAE, like Dubai Media City, Dubai Internet City, and Sharjah Media City, offer freelance permits to individuals to work as independent contractors. They provide legal recognition and various benefits like a bank account, residence visa, and access to business support services.

Freelancing in Saudi Arabia

There is no “freelance permit” in Saudi Arabia, so freelancers need to establish a business entity for work. This is a slightly more complex process as compared to the UAE. Here are the steps involved:

1. Establishing a Eusiness Entity

Individuals need to establish a Limited Liability Company (LLC) or a Sole Proprietorship to be able to work as a freelancer. A Sole Proprietorship is suitable for a single owner, while an LLC requires a minimum of two partners.

2. Chamber of Commerce Registration

Next comes registering your business with the local Chamber of Commerce. You’d have to submit the documents needed, pay fees, and obtain a commercial registration or CR certificate.

3. Municipality Registration and Licenses

You might need additional licenses and permissions from the municipality or other relevant authorities depending on your business and where you’re applying.

4. Taxes and Zakat

No matter which country you work in, it’s important to understand the country’s tax obligations and ensure compliance with rules and regulations. In Saudi Arabia, freelancers are subjected to tax and zakat regulations, and you should be aware of this.

Also Read: How to Receive Payments for Freelance Work?

Freelancing in Egypt

Freelancing in Egypt has been gaining momentum quickly in recent years, especially in fields like digital marketing, content creation, software development, and graphic design. While Egypt is one of the most straightforward countries for freelancers in the Middle East, there are still some important considerations you should keep in mind:

Tax Registration

To avoid any compliance or legal issues, a freelancer is required to register for taxes with the Egyptian Tax Authority. As a freelancer, you’d have to declare your income periodically and obtain a tax card called “Form 1” as well.

Business Licensing

Depending on the kind of freelance work you’ll undertake, you may need to obtain a commercial license from the relevant local authority. This license is necessary to legitimize your business activities and ensure compliance with regulations.

Tax Deductions and Expenses

Proper documentation allows freelancers to deduct certain business-related expenses from their taxable income and save on costs for equipment, office space, and other relevant expenditures.

Contracts and Agreements

Freelancers are advised to have clear contracts and agreements before working with clients. The scope of work, payment terms, and other details that’ll help you establish a professional relationship in front of the authorities will be defined in the agreement.

Onboarding on PayTabs

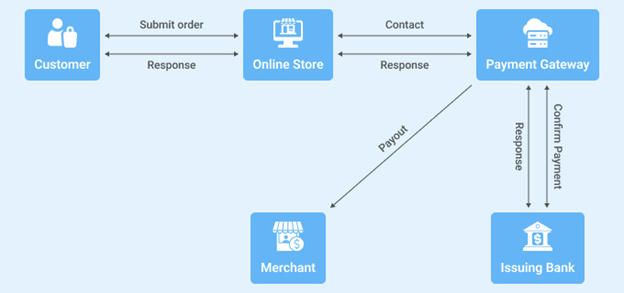

Obtaining a freelancer permit or setting up a business entity is just the first step toward working as a freelancer in the Middle East. You also need to set up a robust payment process for accepting payments from the client.

PayTabs can help you in this regard. It is one of the fastest-growing payment gateway providers in the Middle East, allowing freelancers to get onboarded into their system easily. Once onboarded, freelancers can accept payments in different modes and from different channels with ease. If you’re a freelancer wanting to work in the UAE, KSA, Egypt, or any other Middle Eastern country, here are some things you’ll need to get on board properly.

Also Read: How to Get Paid as a Freelancer

⮚ For UAE

These are the KYC documents needed for a smooth onboarding:

- Freelancer certificate

- Passport, Emirates ID and residence permit or a VISA copy for identification purposes

- Account details through bank account statement or any other document

⮚ For KSA

These are the KYC documents needed for a smooth onboarding:

- Freelancer certificate

- Passport, national ID, or any other government issues identification document

- Extracts of bank statements or bank letters showing the account holder’s details

⮚ For Egypt

These are the KYC documents needed for a smooth onboarding:

- Valid national ID or any other identification document

- Bank account statement or other documents showing bank details

PayTabs, one of the leading payment gateway platforms in the Middle East, is helping freelancers and business owners like yourself to create a sustainable business and accept payments without any inconvenience. Get in touch with us to know more about how PayTabs helps you get onboarded with a freelancer certificate/permit.

Vishal Shah works as an executive at TatvaSoft.com. He is responsible for new technology integrations in development projects. He prefers to share his valuable insights among the development audience by blogging.

Vishal Shah works as an executive at TatvaSoft.com. He is responsible for new technology integrations in development projects. He prefers to share his valuable insights among the development audience by blogging.