Ecommerce vs Digital Marketing: A Comparative Guide to Help Your Business Succeed

These two terms, ecommerce and digital marketing, are often used synonymously. In fact, they refer to two very different things. If you have an online business or work in one, it’s important to fully understand the differences.

Where it gets confusing is that ecommerce and digital marketing often go hand in hand. Both can also exist independently. For example, an ecommerce business could trade without digital marketing. Similarly, digital marketing could be used by a physical business.

Introducing Digital Marketing & Ecommerce

Basically, ecommerce is the act of selling online. Whether that’s through a mobile app or an ecommerce site, it’s all ecommerce. Digital marketing, on the other hand, is the act of marketing through digital channels. Social media ads, email campaigns, and so on. They are similar and often complementary disciplines. Many businesses will make use of both. Almost all businesses will use one or the other at some point.

What do we Mean by Ecommerce?

Let’s look at ecommerce in a little more depth. We’re talking about selling online or through an app. But we’re also talking about how you deliver the goods to your customers. Logistics is an important part of ecommerce.

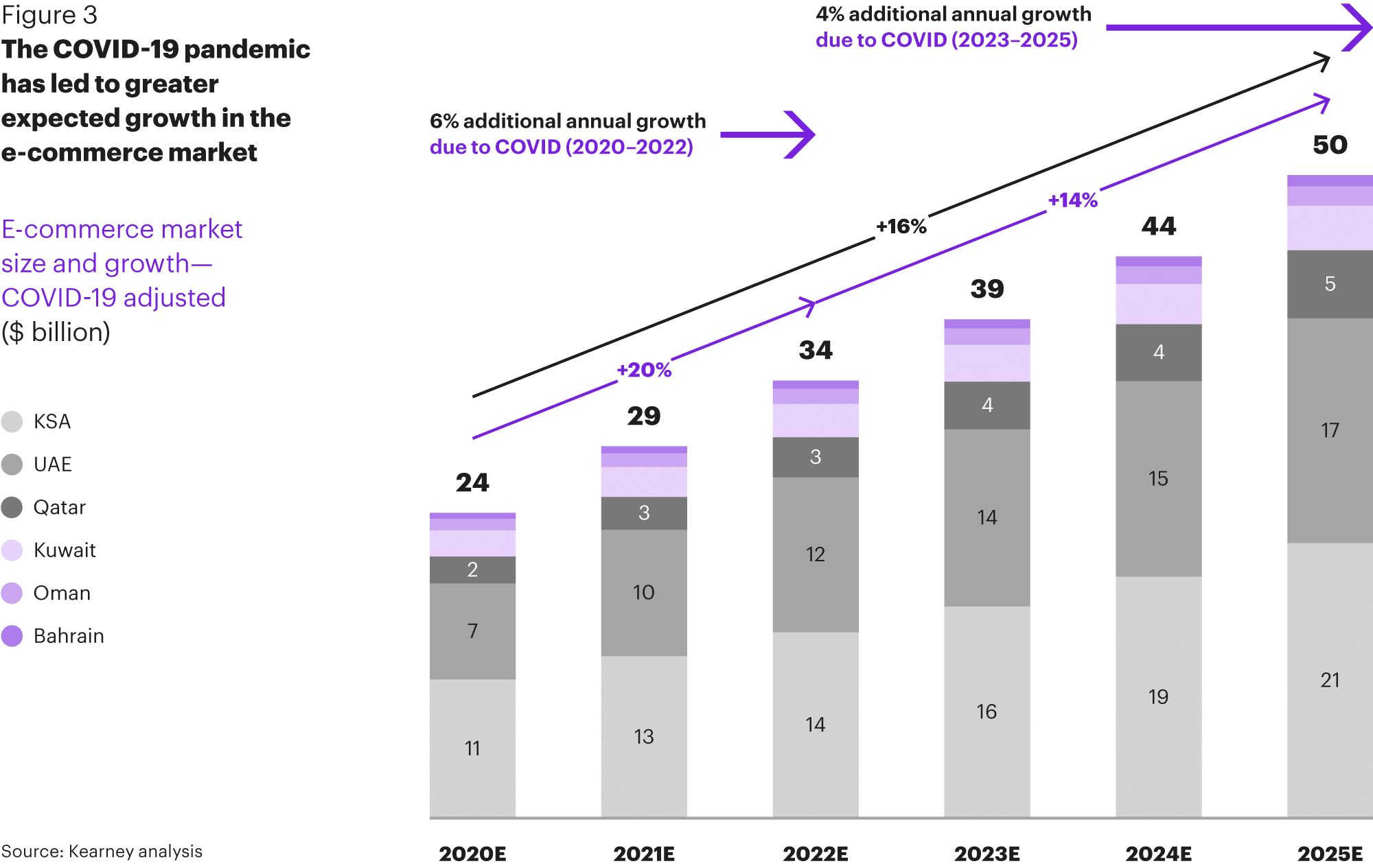

The latest figures show that in 2020 73% of UAE consumers were shopping more online than ever before. With an overall growth in ecommerce sales in the Middle East and North Africa of 19.8%.

This market is expected to grow to $49bn by 2025 . You can see from these figures alone why ecommerce is now a vital part of the global economy. In addition, the growth in ecommerce popularity has led to new opportunities for digital marketers.

What is Digital Marketing?

Digital marketing means any form of marketing using digital means. That means ecommerce applications like banner ads and mobile notifications. But could also mean email campaigns, text adverts, social media ads, and more.

The goal of digital marketing is much the same as any other marketing. You’re looking to promote your brand to the largest number of interested customers you can. Having a digital marketing strategy lets you keep the tone and message consistent across platforms.

Here are some of the more popular examples of digital marketing today;

- SEO

- Email Marketing & Automation

- Viral Marketing

- Social Media Marketing

- Pay Per Click & Pay Per Conversion

- Affiliate Marketing

- Native Advertising

- Image & Rep campaigns

- Point of Sale cross-promotion

Compared with traditional marketing, digital marketing has the advantage of accessibility, visibility, cost and popularity. Digital marketers should look at future trends. Think about questions like ‘how will mobile apps affect the future of digital marketing?’

Can Digital Marketing & Ecommerce Work Together?

The answer is a resounding yes. They can, and should, work together. It’s hard for any business to succeed without making use of digital marketing techniques..

Digital Marketing & Ecommerce Hand-in-Hand

Take the example of a SaaS (Software as a Service) business. What is a SaaS company you ask? Well, they sell software, usually on a supported subscription model, to other businesses. They operate entirely online, with many using remote workforces.

This means there are no physical locations, no passing trade. Every customer has to be gained through direct or indirect marketing efforts. Digital marketing is a vitally important part of the marketing strategy for a business like this. The same is true for many ecommerce sites.

Digital Marketing & Ecommerce for Physical Retail

That doesn’t mean that digital marketing is only used by ecommerce businesses, though. Digital marketing should form an important part of any retailer’s marketing strategy too. Both large businesses and local businesses can boost revenues with digital marketing techniques.

Hosting a blog with local interest pieces can help drive traffic to local companies. Sharing your successes, or the community work you do, on social media can have a big impact on reputation. Digital marketing goes beyond just putting your products in front of the customer.

Remember those ecommerce stats we cited earlier? Well, research also tells us that many businesses in the Middle East reported that in 2020 a quarter of their sales were online. Moreover, 85% of MENA consumers have shopping apps installed on their phones. These figures are only growing year on year.

Image Source

As a physical retailer, ignoring the growth of these markets could seriously harm your business. Even your local customers will appreciate the opportunity to use a website or app if they choose to.

This doesn’t mean you have to move away from your high-street roots. The key for a physical retailer is to make both experiences complimentary. Look at the potential for integrated customer data.

This means that across your online and physical retail options, you make the customer experience consistent. A customer can fill a basket in your app and complete the transaction in-store, or vice-versa.

This should also extend to your digital marketing efforts. If customers sign up for your newsletter, let them use the same email details etc. when they open a customer account.

Does Ecommerce Need Digital Marketing to Succeed?

In short, yes. There are physical methods that will work well for online businesses, but digital marketing will make up the majority of your strategy. You can use consultants or account managers to promote your service.

You could also look at billboards and local news advertising. The problem with many physical methods of advertising though is the cost.

Some digital marketing approaches are also cost-intensive, it’s true. But the wealth of word-of-mouth advertising, available through low-cost social media campaigns, is too much for small businesses to ignore.

Digital Marketing: Practical Benefits

Let’s look at some of the direct benefits of digital marketing that your business could make use of. Many of these techniques require data collection and analysis to get started. So, make sure your records management systems are able to keep up.

Targeted Marketing

This means directing your marketing at the groups who will respond to it best. Using customer demographic data, you can analyze habits and preferences to optimize your advertising. Having a flexible digital marketing strategy allows you to easily run several concurrent campaigns. You can target these at different groups to get the optimal response rates.

This can be very useful if you’re launching a new product or service, too. Target the early adopters, the customers who are most interested in your products. These customers will generally be the most willing to give feedback when asked.

You can integrate this with your quality assurance strategy to gain useful customer data before a general release. Then, make this a part of your qa metrics. This will help you gain a picture of how your customer base will respond to a new product or process.

Personalization

Personalization is becoming an important brand differentiator. This is when a website or app will adjust the adverts, notifications, or the products it shows you based on your customer profile. We’ve all seen examples of it, some apps even do it whether we’re aware of it or not.

According to a recent study of consumers in the Middle East, personalized emails have an open rate of 19.34% in comparison with 7.91% for broadcast emails. There is also a very visible increase in click rate when push notifications are personalized. This jumps from 5.58% to 21.12%

This shows that there is both huge potential in personalization, as well as high customer demand for it.

Loyalty & Satisfaction

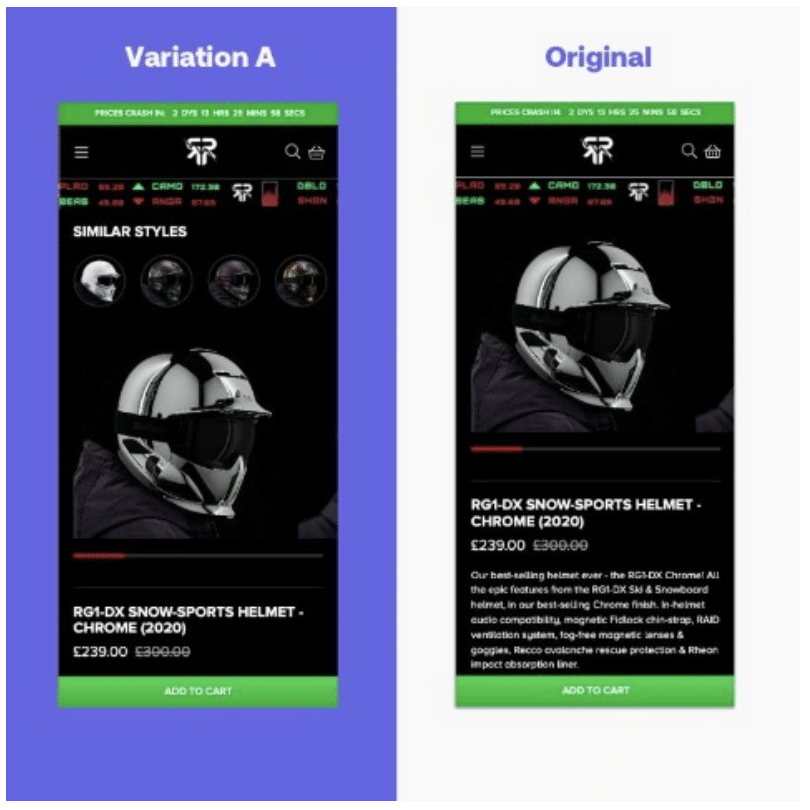

Then, it follows that servicing these demands will increase your customer satisfaction rates. Take a look at this case study on Ruroc, an online retailer. They noticed that engaged customers who arrived via paid ads would often bounce from product detail pages.

Simply by adding a “similar styles” viewer to their app for paid ad viewers saw a huge turnaround. Thanks to this one little touch of personalization, they saw the following changes:

- 19% decrease in bounce rate.

- 67% increase in conversion rate.

- 25% increase in average order value.

- 109% increase in average visit value.

Image Source

Ecommerce: How to Drive Success

So, let’s talk about how we can use these digital marketing techniques in ecommerce for a more successful business.

Personalized Shopping

Use the data you collect from your customers to feedback and improve their shopping experience. Often, your customer’s habits will tell you more about them than more traditional marketing questionnaires.

You might implement push notifications for your mobile app, for example. You could personalize these based on your customers’ shopping habits. Give them personal deals on products that are relevant to them. This way, you’ll see increased uptake rates. This will have a knock-on effect, increasing your average customer lifetime value.

Optimization

Optimizing your platform is important, whether you’re operating an ecommerce site or app. 71% of UAE ecommerce sites have a bounce rate of 50%. One of the main reasons behind this is if a website or app takes more than three seconds to load. The longer the load times, the higher the bounce rate. Make sure you optimize for mobile and desktop.

QA testing should form an important part of your optimization. Testing is very important to a successful app or ecommerce site. Put in place a QA testing strategy and come up with a qa test plan template.

Customer Experience

Customer experience is everything in online retail. According to research, 65% of consumers in the Middle East seek curated experiences. This encompasses all parts of the buyer’s journey. Not just the experience of buying itself, which should be fast and simple. You should also think about the after-sales support, customer service, and reliable delivery.

Final Thoughts

Keep your customer experience in mind, whether you’re pursuing ecommerce, digital marketing, or both. Keep in mind that an integrated digital marketing strategy needs to include all parts of your business. From your sales reps to your remote contact center agents.

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman – Head Of Marketing, Global App TestingKate Priestman is the Head of Marketing at Global App Testing, a trusted and leading end-to-end functional testing solution for QA challenges. Kate has over 8 years of experience in the field of marketing, helping brands achieve exceptional growth and mobile compatibility testing, She has extensive knowledge on brand development, lead and demand generation, and marketing strategy — driving business impact at its best. Kate has also written great articles for sites such as angelhack and CBNation. You can connect with her on LinkedIn.