What is Paymes, and How do Freelance Businesses Use It?

Freelancing can be a tough path to choose. You are always hungry to land more clients but also have to be cagey about the ones you’re already working with. While showcasing your skills and abilities to help a client remains the top priority for almost every freelancer, timely payments are also a matter of significant concern. After all, freelancers don’t have a steady source of income and rely on their clients to pay diligently for the work delivered.

The nature of a freelancer’s work compels them to work with different clients from around the world. While this is good for creating a varied portfolio, it creates difficulties in accepting payments from clients. This is where payment solutions like Paymes come in handy for freelancers.

Paymes is a payment platform designed to make transactions easy and secure for freelancers. The platform is fast becoming a popular option for those who work as freelancers, as it offers many benefits that traditional payment methods do not. In this article, we will explore what Paymes is and how freelancers can use it to their advantage.

What is Paymes?

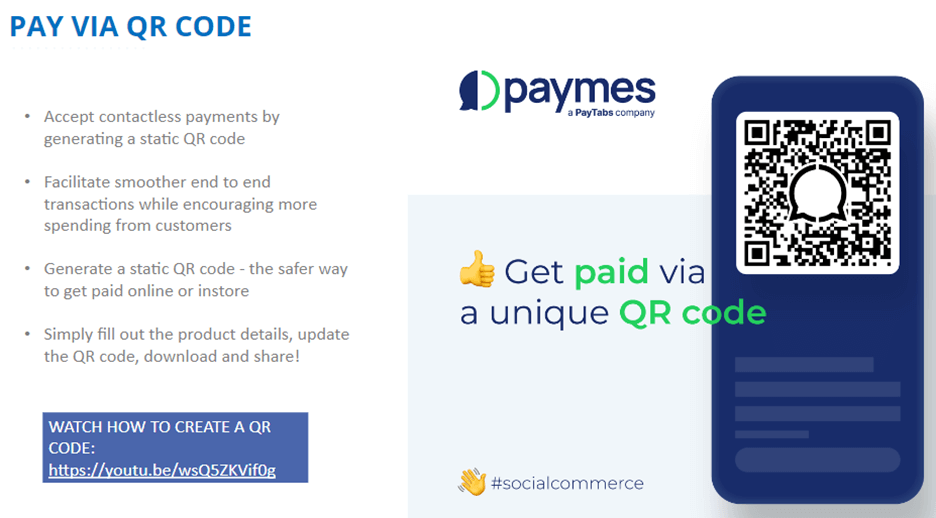

Designed especially for freelancers, Paymes is a user-friendly payment platform that helps them streamline the payment process. It provides several benefits and features to freelancers making Paymes their preferred payment platform. Freelancers can easily track payment status, create or customize invoices, set up automatic reminders for unpaid invoices, and much more.

Freelancers can accept payments via digital wallets, bank transfers, credit cards, or directly from the client through a feature called “Request Payment”. It also provides multiple currency support, making it an ideal option for freelancers working with clients from around the world. Paymes charges a nominal transaction fee and doesn’t charge any payments for using the platform. It can also integrate with various accounting and business management tools allowing freelancers to manage their business and payments without any hassle.

When it comes to security, Paymes leaves no stone unturned and complies with several industry standards such as PCI DSS, PSD2, and GDPR to ensure that your transactions, as well as sensitive information, are secured and away from the reach of any malicious attempts.

How do Freelancers Use Paymes?

Freelancers can use Paymes in several ways to manage their payments and streamline workflow. Here are some key benefits of using Paymes for freelancers:

● Invoicing and Payment Tracking

Freelancers can easily create and customize invoices using Paymes. They can add their business logo, itemize the services provided, add terms and conditions, and specify the payment due date. Once the invoice is sent, freelancers can track the payment status and set up automatic reminders to follow up on unpaid invoices. Freelancers can also view the entire payment history, including the amount, date, and payment method used.

● Accepting Multiple Payment Options

Paymes provides multiple payment options, including credit cards, bank transfers, and digital wallets, which allows freelancers to cater to their clients’ preferred payment methods. Its Request Payment feature allows freelancers to ask for payments directly from clients by sending them a payment link via email, SMS, or social media.

● International Payments

Paymes supports multiple currencies and offers competitive exchange rates for international transactions. Freelancers can receive payments in their preferred currency without worrying about high conversion fees or fluctuations in exchange rates. Moreover, Paymes also handles the complexities of international payments, such as compliance with regulations and taxes.

● Secure Transactions

Paymes uses advanced encryption and security measures to protect the sensitive information of freelancers and their clients. It complies with industry standards, like GDPR, ensuring all transactions are secure and data privacy is protected.

● Competitive Fees

Paymes charges a competitive fee for each transaction, which means that freelancers can keep more of their earnings. It doesn’t charge any setup, monthly, or subscription fees. Freelancers can also save money on transaction fees by grouping multiple payments in one transaction.

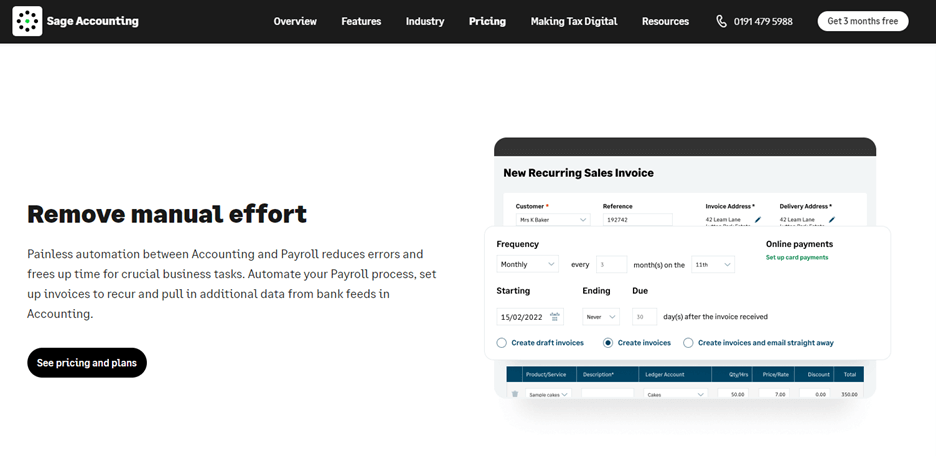

● Integration with Other Tools

Paymes integrates with various accounting and business management tools, such as QuickBooks, Xero, Trello, and Slack, making it easier for freelancers to manage their payments and work. By integrating Paymes with these tools, freelancers can streamline their workflow, reduce errors, and save time.

Conclusion

Paymes is one of the most popular payment platform for freelancers working in the Middle East. It offers them a plethora of benefits that help simplify and streamline their payment process, ensuring faster payment processing, improved cash flow management, and secure transactions. With multi-currency support and competitive fees, freelancers can now work beyond traditional boundaries and interact with clients worldwide. Paymes is a reliable and user-friendly platform allowing freelancers the liberty to focus on their work and grow their businesses. Additionally, its integration with other tools helps lessen errors and saves time. It is a must-have tool for freelancers looking to optimize their payment process and take their business to the next level.