5 Common Excuses For Late Payment (And How To Manage Them)

Posted on

In today’s economy, freelancing has never been more exciting or rewarding. The rise of social media and e-commerce has resulted in an array of creative ventures. Now, freelancers can do business on various platforms, selling goods and services to a global audience. What’s more, social commerce platforms like Paymes make it easier for entrepreneurs to kickstart their freelance venture.

That said, freelancing comes with its challenges, not least the issue of chasing payments. Whether you’re self-employed or run a business with a small team, this can be incredibly frustrating.

Chances are, you’ve been hit with every excuse in the book. So, how do you know which excuses for late payment are valid and how to respond to ensure a swift resolution?

5 Common excuses for late payment

Here are five of the most common reasons you’ll hear for why a payment is late.

1.Cash flow concerns

One of the most challenging excuses to own up to is also frequently one of the most honest.

Financial difficulties can have various causes. Customers might be experiencing trouble at home or loss within the family, which can inhibit or disrupt cash flow. Or they themselves may be waiting to receive payment.

In any case, many people and businesses are susceptible to cash flow concerns, and unfortunately, these repercussions can be far-reaching.

2.Disputes over quality of goods or services

Perhaps the most elaborate excuse involves customers claiming you’re not providing them with the level of quality they expect. Sometimes they’ll have proof; other times, this excuse is a pretext for getting a discount or avoiding paying altogether.

The key here is that they’ve already completed their browse and buy stage regarding your product. They are interested in what you offer in at least some capacity, so it’s worth trying to figure out whether they genuinely received damaged goods or a sub-par service and how you can resolve this.

3.Administrative issues

This excuse covers any situation where admin problems, whether on your end or the customer’s, interfere with timely payments.

Perhaps an email invoice was never sent, you mistyped crucial payment information, or bank details were entered incorrectly.

While these may be innocent mistakes, it does feed into the next excuse.

4.Miscommunication or misinformation

Perhaps a customer was given the wrong information, or worse, no information regarding how to make a payment. It may be a simple case of miscommunication or assuming your customer had the relevant information to make the payment on time. Or perhaps the customer assumed they could pay at a later date.

To avoid this, it’s crucial that you implement a billing and payment process that’s clear and concise for both parties. Remember, if customers don’t receive their bill, they can’t pay you.

5.Willful non-payment

It’s a harsh and unfortunate truth: some customers simply don’t want to pay.

This is not the same as customers disagreeing with you over what they’re paying for. Rather, this excuse is about customers knowing they owe you money but refusing to pay.

How to manage late payments

Now that you know some of the most common excuses for late payment, what can you do when you’re faced with them?

The following tips will guide you toward managing late payments effectively so customers don’t leave you hanging. They’ll also help you maintain a healthy relationship with your customer base.

Set clear payment terms

In business, one of the best ways to avoid miscommunication is to be precise and clear so customers aren’t left with questions about your products or services. The same goes for payment terms.

Naturally, your employees will clearly understand when and how they are paid their monthly salary. You should have the same clarity and control over your incoming payments.

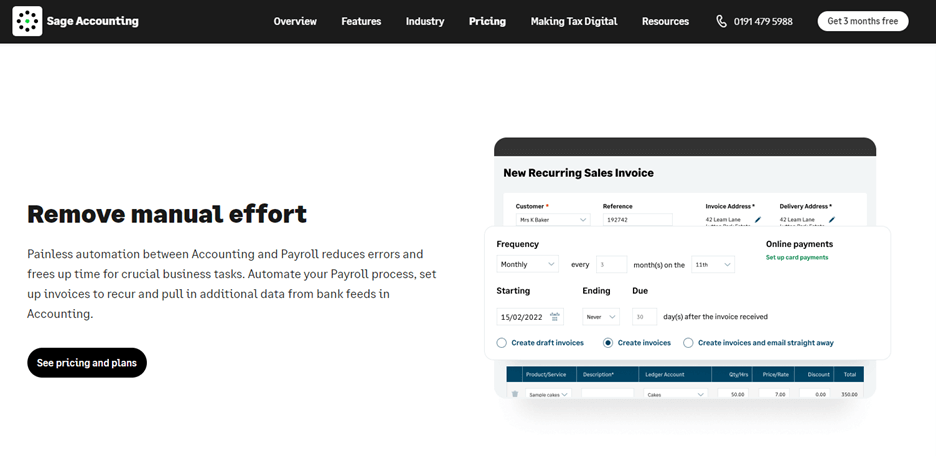

Explicitly lay out your payment process with customers and integrate this into automated services. Accounting payroll software is an excellent tool to help you control your business finances, allowing you to track invoices and overdue payments, set up recurring invoices, and create payslips all in one place. You’ll also be able to customize your invoices to include your payment terms, so it is very clear what they are.

Inform customers of consequences

It would be great to think that having clear terms and an efficient payment process means you’ll always get paid on time. However, the truth is there will always be customers who miss payment deadlines.

With that in mind, always be clear and objective about the consequences of delayed payments. When issuing an invoice, state the payment deadline and mention the course of action if payment is not received on time. This could mean contacting a debt collection agency or issuing a late payment fee.

It tells customers what to expect and gives them a chance to avoid those consequences.

Stay professional

Feeling frustrated or angry when customers don’t pay on time is understandable. However, the way you deal with late payments is a reflection of your company. After all, you never know whether an excuse is a genuine error, so you don’t want to assume the worst of customers and lose their business.

You can assume the best intentions while still standing your ground. A quick ‘I appreciate that this was a no-fault error and would still require payment by [date]’ message can do the trick.

Follow up regularly

A huge part of business success is implementing tools and processes that streamline workflows. You may already have implemented HR management software, which can help you manage employee expenses, track staff performance, and seamlessly onboard new employees.

Similarly, digital solutions can be hugely beneficial when chasing payments. Designated software can be used to issue automated reminders, follow-up messages, and personalized confirmation emails that act as proof of payment.

On top of ensuring a quicker, more seamless resolution to the situation, this lets you apply a personal touch and prove to customers that you care about their business.

Be flexible

Not every solution is suitable for every customer. For that reason, it’s best to stay flexible by suggesting alternatives on your payment page.

For example, you can offer a customer the option to pay half of the agreed sum upfront and the other half after they receive a product or service. You might also offer payment in installments or work on consignment.

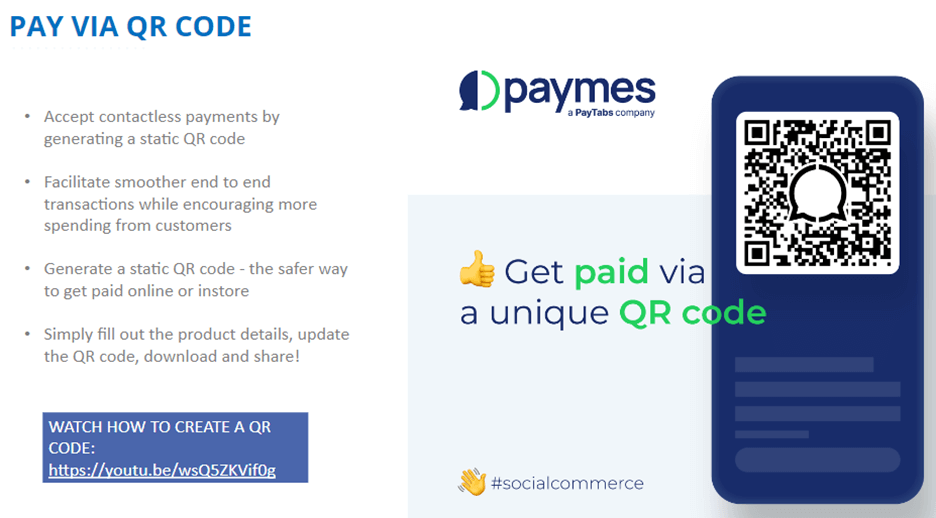

Provide different methods of payment to make it as easy as possible for your customers. For example using the Paymes social commerce platform payment can be made via a link, through the store, or even via a QR code.

This shows that you’re willing to compromise and can help build trust between you and your customers.

Final thoughts

Late payments can result in significant costs for your business. However, it’s essential to act professionally when dealing with excuses for late payment. Be proactive: set clear payment guidelines and ensure customers can pay for services quickly and easily. Try to identify the genuine reason for the late payment, be polite but firm when following up, and always work with your customer to ensure a smooth resolution.

Bio:

Sage is the global market leader for technology that exists to knock down barriers so everyone can thrive. Millions of small and mid-sized businesses, our partners, and accountants trust our finance, HR, and payroll software to make work and money flow. We digitise business processes, strengthening relationships between SMBs and customers, suppliers, employees, banks, and governments. Knocking down barriers also means we use our time, technology, and experience to support digital inequality, economic inequality, and the climate crisis.

Sage is the global market leader for technology that exists to knock down barriers so everyone can thrive. Millions of small and mid-sized businesses, our partners, and accountants trust our finance, HR, and payroll software to make work and money flow. We digitise business processes, strengthening relationships between SMBs and customers, suppliers, employees, banks, and governments. Knocking down barriers also means we use our time, technology, and experience to support digital inequality, economic inequality, and the climate crisis.