Online Store Management Tools

Creating eCommerce stores can be a very complicated process not to mention it’s very expensive and time-consuming. But if you have the right set of tools at your disposal then it might be possible for you to streamline the development process, reduce the costs and manage your eCommerce shop more efficiently. If you collaborate with an eCommerce development company then they can do it all for you while you can sit back and focus on your core KPIs.

But it doesn’t matter if you are building a site in-house or outsourcing it to developers, eCommerce management tools play a vital role in helping business owners develop and manage their online store. They not only help you run your eCommerce business smoothly but also help you grow your sales and stand out from your competition.

A wide range of online store management tools are available in the market and every one of them has something unique to offer but all of them have one function in common, i.e. to help you build, manage and boost your online business. In this article, we are going to discuss different types of tools that can help build and grow your eCommerce business.

7 Types Of Ecommerce Tools

You can build and boost your online store in several ways. Here we are going to talk about some tools that are widely used by eCommerce companies around the world to achieve their goals.

1. Ecommerce Platforms

The most important decision you have to make while creating an eCommerce website is to pick the right eCommerce platform for it. Such tools can take care of all the development-related requirements from building product pages to shipping orders.

- Shopify: Shopify is an eCommerce platform and online store builder. The Shopify app allows you to create a secure online store that can be customized with your own branding, logo, and products.

- BigCommerce: BigCommerce is a platform for online stores, with over 100 integrations with other systems. It has been developed by Shopify and is used by more than 3 million small businesses.

Some other popular eCommerce platforms include Wix, Squarespace, WooCommerce, and more.

2. Content Creation

When you create a website, you also have to create the content to put on it. Sharing content is one of the most effective ways you can make your site visible to potential customers.

- Canva: It’s a tool that can help you with designing even if you don’t have any prior experience. It comes with drag-and-drop tools that make it easy for you to create and share aesthetically pleasing designs.

- WordPress: Not every eCommerce business needs to have a dedicated blog but those who plan on providing one for their customers need to use a CMS such as WordPress. This platform can help you build and manage customer relationships, grow your brand and bring in more traffic with the help of blogging.

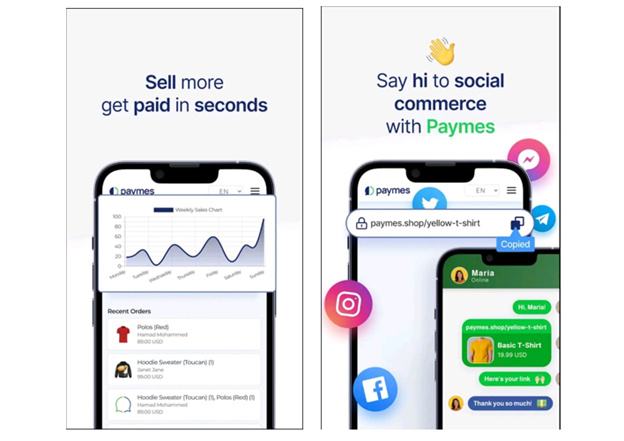

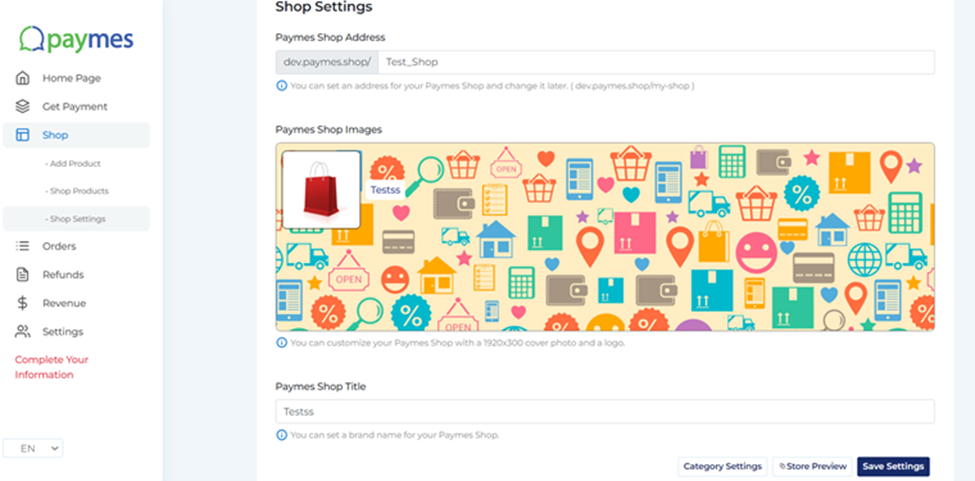

3. Online Payment Tools

Payment tools for eCommerce are essential. There is no commerce without an exchange of funds. eCommerce sites have to integrate with secure payment tools like Paypal, Stripe, and Paymes. It is highly recommended that you use online payment tools that must be trusted by your customers. And yes, you can use multiple payment gateways to provide options or cover your wide range of customers.

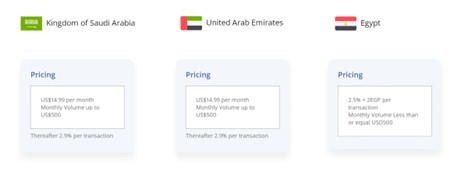

Paymes: It is a secure online payment tool that is popular among customers because it allows you to make secure and instant payments. Paymes also provides you with several payment options including payment via a link or QR code. It is loved by a large segment of home-based business owners, freelancers, consultants, and other professionals.

4. Sales and Logistics

Another important aspect of the eCommerce business is sales and logistics. Many eCommerce platforms provide logistics tools as a part of their services too. If your platform doesn’t offer suitable tools, you can pick standalone options as well.

Shipwire: It is a global platform that manages orders for retail, dropship channels, and direct-to-customers. You will be able to provide logistical support for both national and international shipping if you integrate your marketplace and shopping cart with Shipwire.

5. Marketing

To increase the reach of your site, you can undertake a wide range of marketing campaigns. A variety of marketing tools are available out there that can help you achieve your goals.

Mailchimp: It is a powerful email marketing tool. They provide a dedicated space to share important updates, promotions, and more with customers. It also helps you streamline your entire marketing process by enabling you to create, and track the progress of your email marketing campaigns. And the best thing is it can be easily integrated with any eCommerce development platform.

Constant Contact and Buffer are some other famous options available in the market.

6. Analytics

Without having the right eCommerce analytics tools to track the performance of your site and the user behavior, you can’t expect to get a high return on your investment. These tools are used to gather enough information that can help you make better decisions.

Google Analytics: Probably the most unrivaled, popular, and widely used tool in this article. There’s no doubt that Google is the most used search engine so it makes better sense to use its tools to keep track of how your eCommerce website is performing on search engines. Using Google Analytics, you can gather all the necessary visitor data needed to help you make better decisions.

Apart from Google Analytics, Optimizely is also an efficient analytics tool that would allow you to conduct A/B testing and more.

7. Customer Service

Online shopping seems easy but sometimes it’s hard for a customer to find products to their preferences. To help them through their entire customer journey, eCommerce sites offer customer support services. Better customer service is a good way to retain customers and bring in new ones as well

Zendesk: This popular eCommerce tool enables you to provide customer support through different channels like chat, email, social media, and more from a single platform. Zendesk also helps you troubleshoot your customer support tickets faster.

Final Thoughts

Choosing the right eCommerce management tool can help you a great deal with your online business. It doesn’t matter if you are just about to start your online business or you already have one and are just looking for some way to increase your reach, you can easily find the answer to your problems from the tools we discussed in this article.

However, it is important to mention that not all of these tools are available for free. Some of them offer a free version, free trials, or demos but many of them come with a paid plan as well. You can use this opportunity to decide which online store management tools can help you achieve your goals.

Vishal Shah

Vishal ShahVishal Shah works as an executive at TatvaSoft.com. He is responsible for new technology integrations in development projects. He prefers to share his valuable insights among the development audience by blogging.

Claudia Jeffrey

Claudia Jeffrey

Emily Rollwitz – Content Marketing Executive, Global App Testing

Emily Rollwitz – Content Marketing Executive, Global App Testing