Freedom in what you do

Freelancing, sometimes known as independent contracting, offers workers a way to take charge of their work setup. What jobs you do, when you do them, and who you do them for, become matters that you can control in a way that a direct employee cannot. You may even choose where to work, perhaps hot-desking in a shared workspace or on the deck in the sun.

As a freelancer, you have the flexibility to earn around other life commitments and create a work/life balance that works for you. It’s a model of working that is suitable for many fields. Web designers can ply their trade to a variety of clientele. Freelancing opportunities abound for writers and editors. Graphic designers and artists can take advantage of the growing NFT art marketplace.

There are many important things to consider before pursuing the life of a freelancer. Work can be unsteady. It is up to you to find clients and generate business. Be wary of blurring the lines between work time and personal time. Chief among these concerns is how you get paid. Read on to see some tips for mitigating risks associated with freelancing, and for a basic guide to some of the payment methods available.

Tips for getting paid

- Create an invoice template you can easily edit for different clients.

- Use an easy meeting minutes template to keep track of what you’ve promised to clients and what they’ve promised to you.

- Before signing a contract with a prospective client, do some research to discover if there have been any reports of bad experiences from other freelancers.

- Ensure you have several points of contact with a client. If you’re freelancing for an organization, then make sure you can contact the HR department. You should have an established point of contact for invoicing.

- Try to glean some insight into the finance department structure of client organizations, so you know who to go to if there are any disputes.

How do I get paid?

There are many payment solutions for freelancers to choose from. You need to use those that work best for you and your clients. Below are 6 options for freelancers, along with some benefits and drawbacks for each method. Each payment solution will serve the purposes of some freelancers but not others. This basic guide will help you decide which payment platform best meets your needs.

Paypal

Founded in 1998, Paypal is one of the most well-established and best known methods for moving money around. According to Statista, Paypal had 426 million active users as of Q4 2021. As such a well-known payment platform it may seem like an obvious choice, however, there are pitfalls to be avoided.

Benefits

It is free to set up an account and all you need is an email address. Being such a well-known brand, clients can trust their online payment is secure; they offer robust buyer protection policies. Clients paying you through PayPal don’t actually need a PayPal account. If they are paying via credit/debit card, or with their PayPal balance, payments are sent in minutes.

Drawbacks

The protections PayPal offers are weighted heavily toward the buyer/client. In the event of a dispute, you could find funds are withheld or refunded. If you experience several disputes then you run the risk of your account being frozen. If you travel a lot, you may log in to your PayPal account from a “.co.uk” part of the world one week, a “.de” the next, then a “.ae” (you may be asking, what is .ae domain?) a few weeks later. All this travel can also run the risk of account suspension, although you can communicate with Paypal to outline your frequent travel.

PayPal has higher fees than some of the other options. The amount you pay in fees depends on what country you are operating from, what currencies are being used, and the amounts of money in question. They also charge a conversion rate if you are accepting payments in currencies other than your own. Payments made using electronic checks or bank transfers will be slower because they will need to be cleared by the financial institutions involved.

Bank Transfer

Money can, of course, be moved directly from bank account to bank account electronically. Western Union pioneered the wire transfer back in 1872. They used their telegraph network to communicate between offices which gave the process the moniker of telegraph transfer, by which it is still known in some countries today. These days, secure systems such as the SWIFT banking system ensure the secure transfers of funds.

Benefits

This method is available internationally, with few exceptions. Payments are processed nearly instantaneously when paid domestically, with international payments possibly enduring delays of a couple of days. It is extremely secure and so freelancers and clients can use it with confidence. Once you add your bank account details to your Paypal account, you can simply transfer funds.

Drawbacks

Depending on the banks involved, there can be expensive charges when transferring money internationally. Some banks charge flat fees for incoming and outgoing international payments. For small projects, then, this may be a method to avoid. Unless you have a good relationship with a client, they are unlikely to feel comfortable paying this way as there is little recourse in the event of a dispute.

Escrow

Escrow is a legal and financial agreement that is designed to give the confidence to transact with each other when they are unfamiliar. A third party will hold onto the payment until both freelancer and client are satisfied that work is complete and payment is due. Escrow.com provides this service for a fee.

Benefits

When totally unfamiliar with a client, Escrow can give you confidence that monies are secure in the event of a dispute. Freelancers and clients agree who pays the fees ahead of time and arrange an inspection period of between 1 and 30 days for the client to accept the goods or service provided. They are impartial arbiters, providing a fair way to do business across many countries.

Drawbacks

The fees are quite high. Anything below $300USD is a $10 fee. It’s, therefore, not a good option for small transactions. Although the inspection period can provide peace of mind, it also delays your payment by up to 30 days.

Image Source

Venmo

Owned by PayPal, Venmo is a peer-to-peer payment platform. It is widely used throughout the US as a way to pay someone back for a takeout meal, for example. As an app-based platform, it is a convenient way to make and receive quick payments with no fees for bank transfers or Venmo account transfers, and only a 3% fee for credit or debit cards.

Benefits

Venmo is extremely fast and convenient. Thanks to its app-based structure, you can send notes along with payments and communicate within the app. When transferring money from Venmo to your bank account, you may have to wait one to three days. There is an option for a fast transfer for a charge of 1% up to a maximum of $10.

Drawbacks

Strictly speaking, Venmo doesn’t allow its platform to be used to pay for goods and services. If a client insists on paying this way then you risk having the payment reversed. It’s only available in the US right now and you can’t transfer money internationally. There are few protections for you as a freelancer or a client. It may be suitable for small dollar amounts but use with care and only with clients you have a good working relationship with.

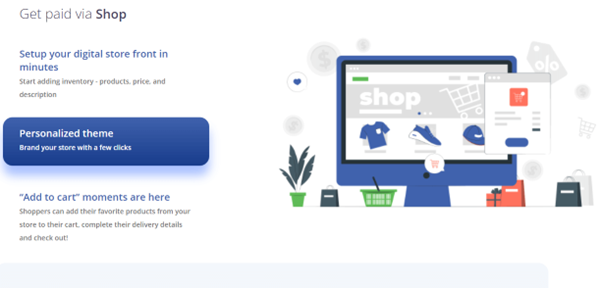

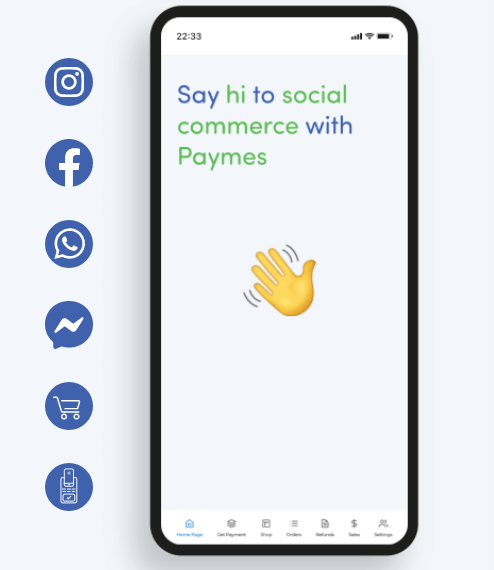

Based in the Middle East/North Africa (MENA), PayTabs social commerce platform Paymes. Paymes is an app-based option aimed at freelancers. It promises a paperless, fast, and secure way to make and receive payments. It is brand new, with some details TBC. If they deliver what’s promised, it could be a viable option for many freelancers.

Benefits

You can create an online store with this platform, so it acts as an advertising tool as well as a payment platform. They are also payment partners with many social media platforms such as Facebook and Instagram. When a client wishes to pay for your service, you share a link or QR code with them. It is a convenient, and intuitive approach.

Drawbacks

There are still details to be worked out with Paymes. They won’t charge set up fees or an annual fee but there will be a transaction charge that is currently unknown. Any charge will likely be comparable to other platforms. Currently, Paymes is only available in the Turkey, Azerbaijan and Egypt.

Skrill

Skrill was once known as Moneybookers. It specializes in international payments using different currencies. With fees comparable to PayPal, it is an option to consider for freelancers regularly working with clients from other countries.

Benefits

Opening an account with Skrill is an easy process. Payments can be made worldwide and only an email address is required. It is safe and secure, being regulated by the UK’s Financial Conduct Authority. Payments can also be made in Bitcoin.

Drawbacks

Once you’ve opened an account with Skrill, there is an onerous verification process to endure. You will need to provide a photo ID along with a utility bill. Users complain of a slow process. They also complain about lackluster customer support, a chatbot for existing customers.

Image Source

Payment power in your hands

Freelancers exert a lot of power over their ways of working. You’ll have to decide where you work, when you work, and for online-based working, choosing between single tenant vs. multi tenant cloud-based software.

When deciding on the choice of payment method, you will have your own unique things to consider. Use a meeting minutes generator to help you decide what the client will be comfortable with, in regards to settling bills. You are now equipped to find a payment method that best suits your needs.

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad

Jenna Bunnell is the Senior Manager for Content Marketing at

Dialpad, an AI-incorporated cloud-hosted unified communications system that provides valuable call details for business owners and sales representatives. She is driven and passionate about communicating a brand’s design sensibility and visualizing how content can be presented in creative and comprehensive ways. Jenna has written for sites such as

Promo and

eHotelier. Check out her

LinkedIn profile

Madeline Miller

Madeline Miller

Sara Sparrow

Sara Sparrow

George J. Newton

George J. Newton

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad