Paymes: The Best Social Commerce Platform For Freelancers

Paymes is a one-stop platform for freelancers from where you can process your payment transactions for any product or service you sell. Paymes not only process your payment transactions but provides freelancers with an option to create a customized shop where you can showcase your products and services.

According to studies, the most common issues freelancers and small businesses face are representing their services and receiving payments from clients. About 82 percent of small businesses suffer from cash flow issues. With Paymes, freelancers can overcome both of their challenges.

Let’s look at some of the amazing features of Paymes, which make it one of the best social commerce platforms for freelancers.

1. Easy Access

About 90 percent of freelancers work from home and often deal with clients at odd times. According to a survey, 56 percent of freelancers face challenges while accessing their laptops when their clients contact them in urgency. They are unable to send them payment links and cannot represent their product details right at the moment.

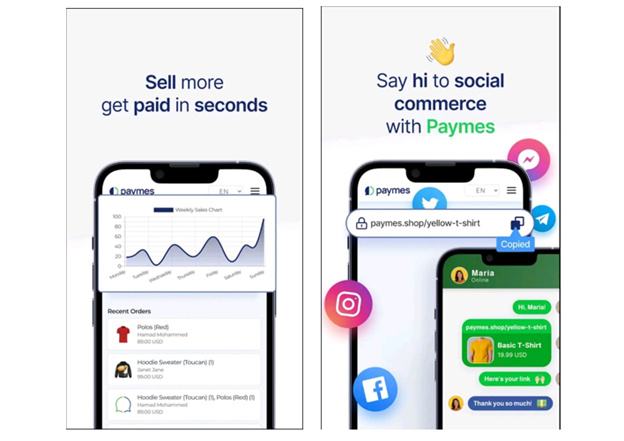

Paymes can be accessed through your mobile and are available on the store for Android and iOS users. Simply download the App, and you can enjoy similar features as on the desktop. The App guarantees complete security of your data, and the data is encrypted in transit.

Furthermore, you can analyze your sales with a user-friendly dashboard, and payment links can be easily shared across social media networks.

You can download mobile apps using the below links:

For Android: https://play.google.com/store/apps/details?id=com.paymes.app

For IOS: https://apps.apple.com/us/app/paymes/id1612045979

2. Customized Product Options

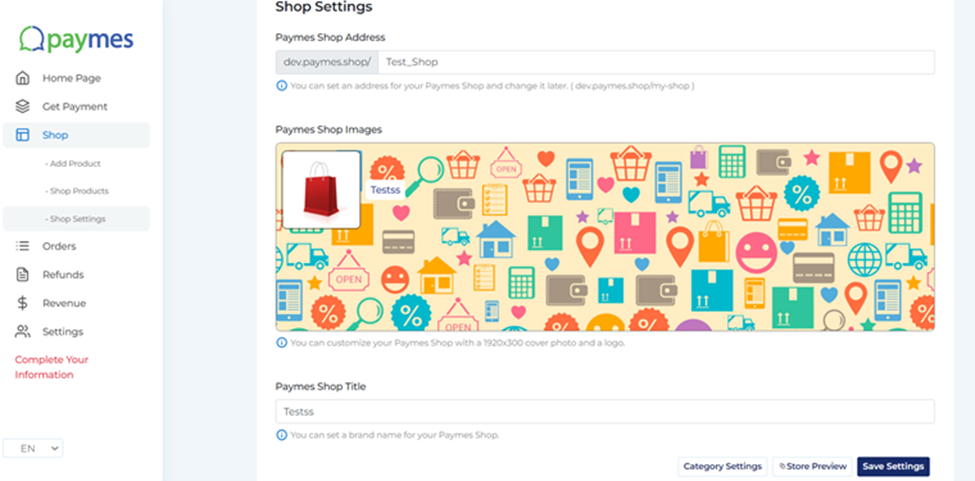

With customized options, Paymes offer a variety of features with its shop. You can simply create your own shop with a few simple steps. Customize the theme according to your services and products and share it with the clients.

Paymes is supported by Facebook, and you can promote your shop products on more than ten social media platforms, including Instagram and WhatsApp.

Simply set up your shop, add product pictures and details, set up the background of your shop and share it with the clients.

3. Zero Set Up Fees & No Hidden Charges

As rightly said by hbr.org, it’s time to ban hidden charges. Another major concern freelancers suffer from is hidden charges and huge transaction fees charged by payment processing companies. Freelancers are unable to make the proper calculations, and often they sell their services without earning the profit they deserve.

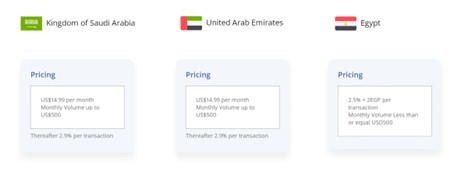

However, this is not the case with Paymes. There are no registration fees. It is completely free with zero hidden charges. Paymes know what freelancers have to suffer from. Hence they have kept a transparent transaction fee of 2.9 percent in Suadi Arabia and UAE and 2.5 percent + 2EGP in Egypt.

We will explore some more features of Paymes in the next part of this article.

Claudia Jeffrey

Claudia JeffreyClaudia Jeffrey is currently a Manager of R&D at Crowd Writer UK She has been working as a Freelancer for the past 11 years and has served several clients worldwide. In her leisure time, she tries new recipes and travels across the globe to explore the nature of Earth.

Emily Rollwitz – Content Marketing Executive, Global App Testing

Emily Rollwitz – Content Marketing Executive, Global App Testing

Jenny Han

Jenny Han

Alex Husar

Alex Husar