Top 5 Payment Gateway APIs That Every Developer Must Know

Almost every organization has an online presence today, and payment gateways have become an essential part of online transactions. Payment gateways enable businesses to receive payments from their customers through various modes, including debit cards, credit cards, net banking, and mobile wallets. In other words, an API for payment gateway simplifies life for both merchants and shoppers by saving time and eliminating the hassle of carrying or handling cash, thereby minimizing inaccuracies and inefficiencies. As a developer, knowing about the top payment gateway APIs available to integrate into your web or mobile applications is crucial. In this article, we’ll discuss the top 5 payment gateway APIs that every developer must know.

What is Payment Gateway API?

Payment Gateway APIs are software interfaces that allow businesses and developers to accept online payments securely and efficiently. A payment gateway is a service that processes online payments and authorizes transactions between merchants and customers. Payment gateway APIs provide a set of protocols, tools, and guidelines that enable developers to integrate payment gateway services into their applications.

What Happens After Payment Gateway API Integration?

When a customer makes a payment through a payment gateway, the payment gateway API communicates with the payment processor to verify the payment details, authenticate the payment card, and approve or decline the transaction. The payment processor then sends a response back to the payment gateway, which is, in turn, communicated to the merchant or application. Seamless payment gateway integration with API ensures that all of these steps happen in just seconds, so that checkout is quick and the customer experience is as smooth as possible.

Importance of API Payment Gateways

Payment gateway APIs are essential for businesses that want to accept payments online as they provide a secure and efficient way to process payments. Payment gateway APIs typically offer features like fraud detection, recurring billing, invoicing, and dispute resolution to ensure that transactions are processed smoothly and securely.

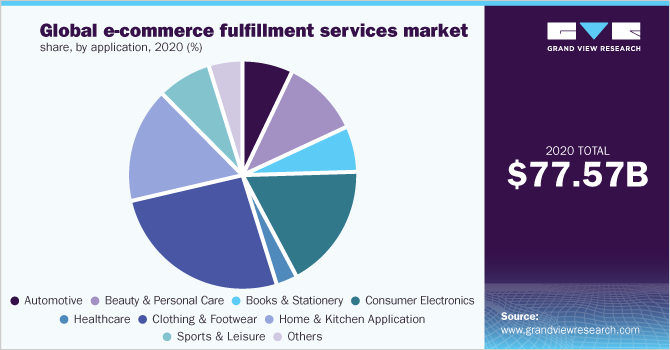

Payment Gateway APIs also support various payment methods like credit and debit cards and alternative payment methods such as e-wallets, mobile payments, and bank transfers. This offers ample flexibility to shoppers, enhancing their overall journey, earning their confidence, and motivating them to make repeat purchases in the future. Using API for payment gateways also enables businesses to accept payments in multiple currencies from customers worldwide. This promotes growth beyond borders, strengthens the brand image and value, augments the customer base, and boosts sales and revenue.

Top 5 Payment Gateway APIs

PayTabs API

PayTabs is a popular online payment gateway in the Middle East, North Africa, and Southeast Asia. PayTabs API enables developers to accept payments through various modes like debit and credit cards, as well as alternative payment methods like Apple Pay, Google Pay, and Samsung Pay. It also provides features like recurring payments, invoicing, fraud detection, and dispute resolution.

PayTabs API is available in various programming languages like PHP, Ruby, Python, and .NET, making it easy for developers to integrate into their web and mobile applications. It also provides SDKs for Android and iOS platforms, making it easier for developers to integrate PayTabs into their mobile applications.

PayTabs is an API payment gateway that offers various payment options, including Visa, Mastercard, American Express, and Discover. It also supports local payment options in multiple countries, like Mada in Saudi Arabia, Qiwi in Russia, and FPX in Malaysia. It provides a user-friendly dashboard to manage payments, refunds, chargebacks, and transactions. The dashboard also provides detailed analytics and reports, so you can closely monitor your business’s payment activity, detect any gaps or lapses, identify areas of opportunities, and take informed decisions to improve the bottom line.

PayPal API

PayPal is one of the most popular payment gateways globally, with over 300 million active users. PayPal API enables developers to accept payments globally through various payment modes, including debit/credit cards and PayPal balances. It offers additional features like fraud management, dispute resolution, and recurring payments. This promotes greater transparency between the merchant and customers and provides essential support to businesses that operate subscription-based models. Developers can integrate PayPal API with web and mobile applications using various programming languages like Java, .NET, and PHP.

Stripe API

This popular payment gateway is used by many companies globally. Stripe API enables developers to accept payments through various modes like debit cards, credit cards, and mobile wallets. It also provides features like subscription management, recurring payments, and fraud detection. Developers can integrate Stripe API with web and mobile applications using various programming languages like Ruby, Python, and PHP.

Braintree API

This is a popular payment gateway acquired by PayPal. Braintree API for payment gateway enables developers to accept payments globally through various payment modes, including e-wallets and debit or credit cards. Braintree also provides features like recurring payments, fraud detection, and dispute resolution. Developers can integrate it with both mobile and web applications using different programming languages like PHP, Ruby, and Python.

Amazon Pay API

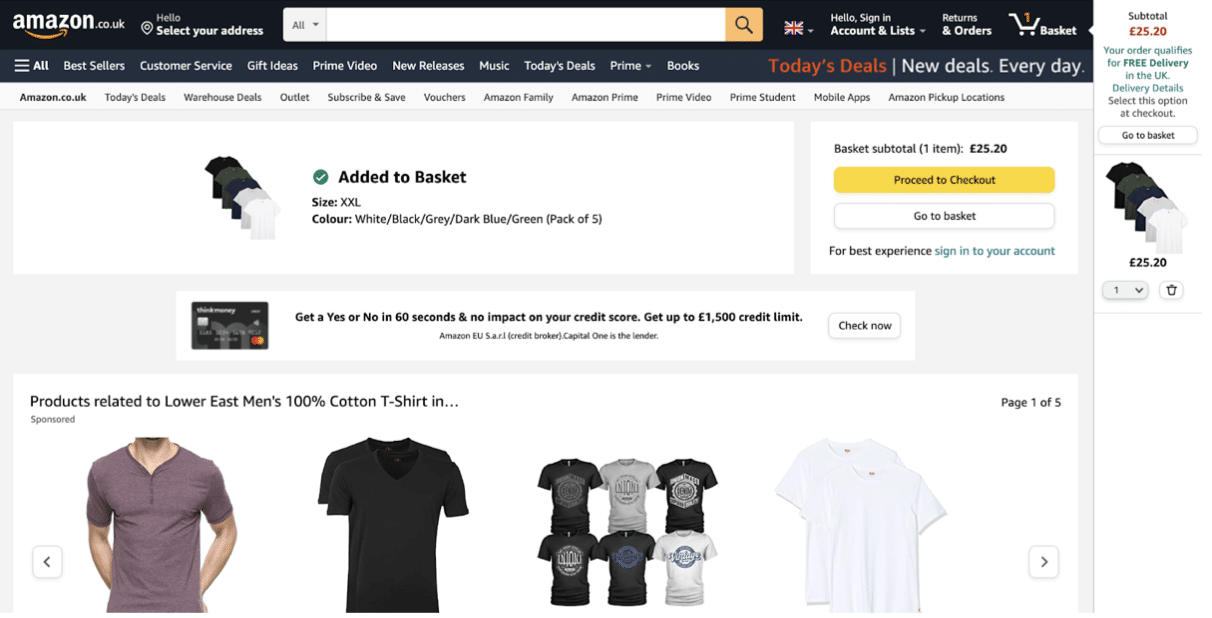

Amazon Pay is an API payment gateway used by businesses globally. Amazon Pay API enables one to accept payments via debit cards, credit cards, Amazon Pay balance, and other options. It facilitates secure and glitch-free transactions through features like fraud detection and dispute resolution. This way, customers know that their hard-earned money and sensitive financial information will stay safe, while merchants know they will receive their dues on time. Developers can integrate it with both web and mobile applications using programming languages such as Java, PHP, and .NET.

Conclusion

Payment Gateway APIs provide an essential service that enables businesses to securely and efficiently process online payments. Payment gateway APIs offer a wide range of features and support for various payment methods, making it easy for companies to accept payments from customers around the world and scale beyond geographical borders.

PayTabs is a leading payment gateway API that provides businesses in the Middle East, Southeast Asia, and North Africa with a user-friendly and secure platform to accept online payments. With features like recurring billing, invoicing, and fraud detection, PayTabs API enables businesses to streamline their payment processes and improve their customers’ payment experience. By leveraging PayTabs API, developers can easily integrate payment gateway services into their applications and offer a seamless payment experience to their customers in these regions. At the same time, business owners can track all transactions and business performance on a single dashboard and strategize better for a more profitable future.

FAQs

• How does a Payment Gateway API work?

An API payment gateway facilitates the process of online purchase on a mobile application or website. It connects your business’s checkout system with the payment gateway. In other words, the payment gateway API captures details like card number, amount to be paid, mode of payment, currency being used, etc. to authorize money movement from the customer to you. Next, the API sends the payment request to the relevant processor. Once the transaction is successfully completed, you will be intimated by the payment gateway and the customer will receive an order confirmation.

• How can Businesses Integrate Payment Gateway APIs into their Websites?

The integration process requires businesses to incorporate the relevant software development kit (SDK) and code / protocol and then configure the API settings. After onboarding merchants, top payment gateways offer detailed tutorial and documentation on authentication methods, endpoints, and other details, along with sample codes, so that developers can go about the task of integration easily. Technical support and troubleshooting services are provided later as well to ensure a smooth transition and seamless everyday operation for the business.

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman – Head Of Marketing, Global App Testing

Jessica Day – Senior Director, Marketing Strategy, Dialpad

Jessica Day – Senior Director, Marketing Strategy, Dialpad