Finding the Best Payment Gateway for Your eCommerce Business Made Easy

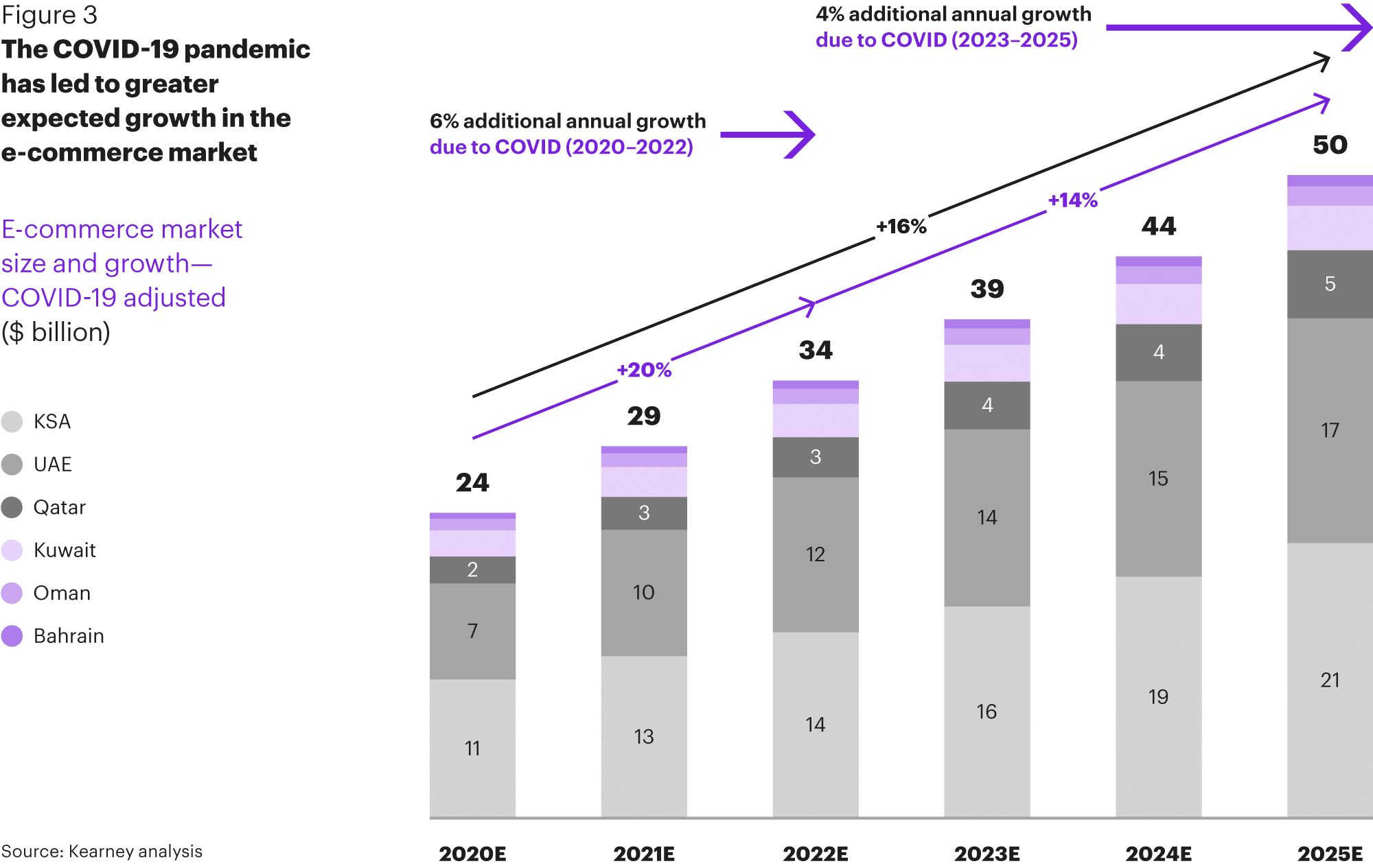

Running an eCommerce business is sure lucrative in a world that has gone online for quite some time now. But it works only if you deliver an awesome customer experience and receive your payments smoothly. Which is why, picking the right payment gateway is so important. It is a vital bridge connecting your consumer and your product. With a reliable, secure, and advanced gateway, making and receiving online payments can become a breeze. It will minimise business risks, ensure secure transactions, reduce instances of shopping cart abandonment, and provide a better brand experience overall.

In fact, it might interest you to know that more than 50% of online shoppers abandon eCommerce portals without completing their transactions. Reports have shown that the payment page experience plays a significant role in influencing your customers’ shopping journeys. About 17% of all online customers today don’t trust online shopping sites with credit card details. 6% of customers abandon their carts because their choice of payment card wasn’t available. About 4% leave your site because of technical glitches.

So, it is evident that choosing the best payment gateway for eCommerce transactions plays a significant role in determining profitability and brand experience. Read on to know how you can go about it.

What is a Payment Gateway and How Does it Work?

Payment gateways aim at conducting simplified transactions while ensuring the security of sensitive customer information shared during this process. Different types of payment gateways use different security protocols to ensure customer data security. This includes encrypting details like bank and card numbers, one-time passwords, etc.

So, if you have an online business, it is vital that you know how a payment gateway works so that you can identify problems when something goes wrong. Here are the steps followed to complete a transaction through a payment gateway for eCommerce websites:

Step 1: A client or customer adds items to their cart, confirms their order, and clicks on Checkout.

Step 2: The eCommerce portal or website redirects them to the payment gateway page. Here, the customer must enter all the required data about the card they intend to pay with, the issuing bank details, etc. The payment gateway takes the customer directly to a secure 3D or issuing bank page, depending on the type of payment gateway, for transaction authorisation.

Step 3: Once the transaction is authorised, the bank performs its checks (validity, available balance, etc.) and either approves or rejects the transaction. If the transaction fails, the customer receives an ‘error’ message and must try again from the start.

Step 4: Else, the issuing bank approves the payment and transfers the funds to the payment gateway, which in turn settles the amount with the seller, which is you.

Step 5: Once each of these steps has been completed, the customer receives a message of confirmation stating the order has been placed.

From these steps, you can clearly see that every monetary transaction on an eCommerce portal requires the exchange of sensitive data. Bank details and card information are highly personal and can have a deeply negative impact if leaked. Thus, all vendors and types of payment gateways for eCom payment processing must ensure complete security around personal user information.

Using a reliable and credible vendor for your payment gateway services is an effective way to ensure that data does not get leaked. Such vendors offer strong countermeasures, data insurance, and other features that ensure data is not leaked or that the damage is minimised should a leak ever happen.

Types of Payment Gateways You Can Choose From

Now that you know what is a payment gateway and how it works, ask yourself which type of gateway solution do you need for your business? There are basically two types of payment gateways to choose from:

- External or hosted payment gateways: These payment gateways are integrated with your primary eCommerce website. However, for every transaction, it redirects users to your payment gateway page to complete transactions. The primary benefit of this type of payment gateway is that you don’t need to worry about transaction safety. The payment gateway provider takes full responsibility for transaction security and platform compliance. External gateways are also easy to set up and don’t need customisation.

- Direct or integrated payment gateways: This type of payment gateway doesn’t require the customer to leave the host website. As the merchant, you are responsible for all the interactions that take place since they take place on your website. The greatest benefit of integrated payment gateways is that you can provide a much better and more personalised user experience. You have the option of tailoring your checkout process so that it fits your business requirements and strategy. This ensures a seamless experience and is ideal for mobile transactions.

6 Factors to Consider While Choosing Gateway Payment Solutions

Since there’s a lot that depends on your payment gateway, it’s critical to make the right choice. However, with so many options available, it could be hard to choose. Keeping the following factors in mind can make this process easier though.

- Availability of services: You need to know where most of your customer base is located. Depending on this, you need to choose a payment gateway that is available in the country where you are doing business and where your customers are. Almost every gateway provider has a list you can check against. You can also email them to confirm.

- Transaction fees: Every gateway provider levies charges on transactions based on several factors. This could be the payment method, type of card, number of transactions per month etc. Make sure you choose the right criteria, or else your transaction fees might exceed your monthly profit.

- Recurring payment system: Several businesses today use a subscription-based model to sell products and services. This could be like OTT platform subscriptions, membership plans, or rented furniture. If you are in the subscription business, you need a payment gateway that enables repeated payments. This means your customers won’t have to make manual payments every time a payment cycle ends. A few payment gateway providers also offer advanced features that let customers upgrade plans easily, pause payments, or add new subscriptions. Before you finalise a provider, make sure they have all the services you will need.

- Miscellaneous fees and charges: Another key factor that you need to consider is the accumulation of non-transaction fees that gateways might charge. These could be fees for setting up your account, maintenance charges, deposit or withdrawal charges, fees for chargebacks, and more. If you are just starting and sales are not that high, these fees could bring down profitability significantly.

- Customer payment mode options: As an online merchant, you need to ensure that completing a transaction is as easy as possible for your customers. For this, you need a payment gateway for eCommerce that accepts payments from the maximum possible card processors and issuers as well as all types of mobile wallets. Having limited options while wanting to make payments could drive your customers away.

- Payment security: In case of online business platforms, fraud is a real concern. Several online shoppers are concerned that their data isn’t safe on eCommerce platforms. There are several regulations in place such as the PCI DSS (Payment Card Industry Data Security Standard) system that gateway providers must comply with. Make sure you choose a vendor that meets these standards.

Choose Payment Gateways that Secure Customer Information

The best payment gateways ensure that your data is always safe. Here is a look at some of the fundamental implementations and protocols that a payment gateway follows to provide data security:

- Every online data transaction going through a payment gateway is conducted using an HTTPS address. The S stands for ‘secure’ and sets it apart from the average HTTP address. The transaction passes through this secure channel.

- Due to the # function, payment gateway systems generally use signed requests from the seller for validating the transaction request. This request is in the form of a secret code word known only to the payment gateway and the merchant.

- To ensure the payment page is secure as a result of this process, the requesting server’s IP is first verified, ensuring it detects any dangerous activity.

- VPA or Virtual Payer Authentication is currently being backed by issuers, payment gateways and acquirers, so that the payment process is even more secure. VPA is implemented in compliance with the 3D secure protocol. It provides an additional security layer and gives online sellers and buyers easier authentication of the opposite party.

Select the Right Payment Gateway and Enjoy these Benefits

There’s more than one benefit of using the right payment gateway for your online business.

- PCI-DSS Wallet: Compliance with PCI-DSS ensures adequate security for users to securely save personal data in the gateway or portal for easier recurring payments. This is how you can save multiple cards, UPI IDs, and mobile wallet information on a payment page.

- White-Label Wallet: Certain types of payment gateways enable users to carry out digital transactions using mobile wallets and applications. This is among the most popular current trends as it allows users to complete multiple transactions without any hassle or friction. Money from the mobile wallet can be brought to the website and then used to complete transactions on the seller’s platform.

- Fraud Screening Tools: Several payment gateway systems offer you fraud screening functionalities and tools to mitigate the risk of data loss. This includes the CCV, CVV and AVS numbers, among others. Providing these additional layers of security ensures that no one can carry out transactions using the card details saved on your page.

The primary focus of payment gateway systems is to create secure paths between merchants and customers and facilitate secure payments. It mandates the authentication of both parties from their respective banks.

The key benefit of a payment gateway for eCommerce website is that millions of users can use a single gateway simultaneously. This makes it possible for businesses to buy or sell products or services around the clock.

So, when looking for payment gateways for your business, keep this guide handy. With the growing level of competition in the eCommerce space, let your payment gateway solution be the differentiator. Partner with the right provider to improve customer experience and drive brand loyalty.

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman – Head Of Marketing, Global App Testing