The “From Home” concept is pretty much in vogue. Whether it’s work from home or shop from home, the world seems to be happy and completely set with such a routine. I mean is there anybody around who doesn’t love or who seems to be tired of online shopping? Nobody, I guess and why not! Since it’s a fast, fanatic, cool, convenient concept and above all, quite secure and a big time-saver.

Introduction

In today’s times, it is quite a safe bet to say that eCommerce websites seem to have become quite a massive aspect of our day-to-day lives. Okay, tell me in the current week how many items have you ordered online? Be it accessories or apparel, home decor, groceries and whatnot! No wonder, eCommerce stores such as Amazon, Flipkart, and eBay, keep on brewing up and becoming multimillion-dollar ventures.

There is no denying the fact that online retailing is gaining popularity slowly and steadily and is here to stay for the long haul. So do not make the mistake of ignoring such profit-spinning realms. In today’s times, developing your very own eCommerce website can be pretty beneficial since you no longer need to own a physical store and things can be well taken care of from a small space, let’s say your living room as well.

Furthermore, are you keeping tabs on your competitors? If not, you must see how they have developed a strong online presence and raised their bar. Well, there are several other benefits offered by conducting an eCommerce development project. Just make sure you choose a reputable eCommerce development company that carries immense expertise and has a proven track record of developing successful eCommerce websites.

- Low operating costs – Of course, conducting an ecommerce website project can be way more cost-effective than establishing a full-fledged physical store where you need to look around for different spaces to rent and create a relevant-looking infrastructure, basically investing a hefty amount even before commencing the business. Whereas when you plan to open an eCommerce store, you no longer need a separate physical space, also you can offer round-the-clock services if you want, and the investment is pretty less in comparison to opening an entire physical store.

- Increased customer reach – The next benefit of considering an eCommerce store is great customer reach. Yes, local stores tend to attract a few customers, especially the ones hailing from your area. Whereas when you have an eCommerce website, you may come across customers from different countries or regions at the same time since they are using their laptops and smart devices to shop. Gone are the days when the traditional form of marketing was in vogue, now it’s all about offering seamless services online and creating a large customer base which can act as word of mouth and ensure more and more customers to your website. All you need to do is target:

- Millennials and Gen X

- All Geographics

- Seniors, baby boomers

- High-end flexibility – The next amazing advantage of conducting an eCommerce development project is that it ensures high-end flexibility and scalability. You see, it’s not like physical stores where you need a set of people ranging from a cashier to a security guard, receptionist, salesman and so on to run them smoothly. Not to mention physical stores tend to have more monthly maintenance costs whereas that’s not the case with an eCommerce store. Moreover, you can even think about managing several eCommerce stores even if you are using one single platform.

So if you want to go global, offer round-the-clock services to your valued customers, establish and strengthen your brand seamlessly, offer easy and more convenient services, and create better marketing opportunities then without a shadow of a doubt choose eCommerce development. Moving on, further, we will discuss what is the next step to take after you have decided to conduct an eCommerce web development project. Well, for starters you can think of choosing or hiring a reliable ecommerce development company that carries immense expertise and experience in conducting such projects for their clients.

Now can you tell me why not all eCommerce projects or eCommerce websites tend to succeed even if they are fast, convenient and pretty much in vogue? Well, this is only because of one factor which cannot be ignored at any rate. I am talking about none other than transaction security. In the end, your customers will be happy if they end up checking out in the most possible smooth and seamless manner. So what is more important here, incorporating an easy-to-use and highly secured payment gateway.

Introducing Payment Gateways

A payment gateway is something through which you can make your e-store seamlessly connected with the bank. And not just that, you can perform several tasks such as:

- Checking if you have enough balance to buy the product

- Conducting authorized payment procedures and sending the money safely to the merchant’s account

- Easy subscriptions

- Returning the money conveniently within 5-7 business days

- Canceling the transaction and returning the money

Payment gateways is the sure-shot way through which all kinds of payments are possible. Imagine such complex transactions are well taken care of within the span of a few seconds. Payment gateways are also responsible for encrypting crucial aspects such as debit card or credit card information, google pay, CVV, and expiry date, and safeguarding all this information from unwanted and unnecessary malicious attacks.

Technically speaking payment gateways are way more complicated than you can see. Here as soon as the transaction is conducted, money is received from the buyer’s account. This is possible when the payment processor links the customer’s bank with your bank and passes information safely.

Payment Gateways Integration

With the continuous advancements happening around, lots and lots of new horizons seemed to have opened up for both businesses as well as customers. Whatever you need, you have a wide range of tools, technologies and products available and that too without paying extravagantly. Now payment gateways are generally of two types: hosted gateways and integrated payment gateways. Hosted payment gateways are the ones which may not be directly linked to the website but customers are seamlessly redirected to the platform where transactions can be processed. You might end up checking out on the site but the payment happens off-site only. Some of the common yet known examples of hosted gateways are PayPal and 2Checkout.

Whereas integrated payment gateways on the other hand is said when the gateways are directly linked and well-integrated with the website. All this is done using a simple API (Application Programming Interface). Here payments are generally made on-site and directly to the store. Businesses are required to pay for installation and integration services. Moreover, this type is way more effortless and smoother and highly recommendable for large and mobile-friendly businesses.

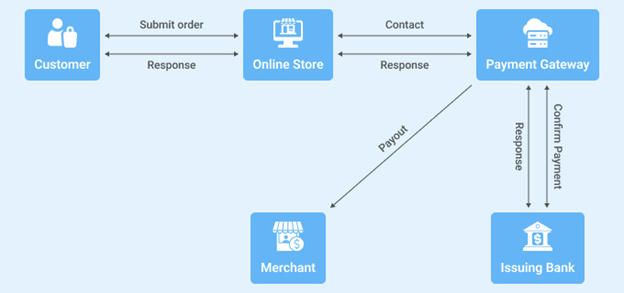

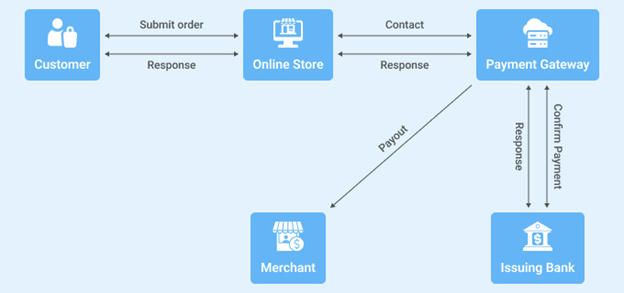

The working of a Payment Gateway!

First and foremost, the process begins with a customer submitting the request and then once the request is submitted, encryption is initiated and all the private information and sensitive card details are kept safe. Next, the payment processor receives funds and this is how a successful payment transaction is done.

Choosing the Right Payment Gateway

Fortunately, there are several payment gateways available across the globe. Well, to make your choice easier, we would like to shed some light on some of the most popular and tried-and-tested payment gateways that offer a wide range of benefits and advantages. Also, you can never go wrong by choosing any of these below-mentioned payment gateways.

#1 PayTabs

Being one of the award winning payment gateway, PayTabs has been a game changer across the globe. The payment gateway ensures seamless sending, receiving and sharing invoices with the help of email, QR codes, SMS and even Whatsapp or different popular social media channels. Yes, you read it right, social media channels, it is possible to share secured payment links via facebook and instagram, etc. Paytabs is also helpful when it comes to receiving repetitive amounts such as subscriptions, membership fees, etc.

Gone are the days when paperwork was given pretty much importance. Paytabs ensures there is no paperwork and instant onboarding involved. Other relevant features that make Paytab one of the leading payment gateways across the globe include an amazing dashboard, secured payment links, repeat billing, quick and easy integrations, different payment methods involved and secured payments. Speaking further about security, it may quite interest you to know that the platform is created with a two-layered fraud protection system that ensures nothing less than secured payment processing.

#2 Paypal

Now I am sure there is nobody who doesn’t know what Paypal is or at least might have heard about the term before. Well, this one turns out to be the most universal payment gateway found and is suitable for almost any and every business across the globe. The payment gateway in particular supports different payment methods and services such as PayPal Payments Pro, PayPal Express Checkout, and Braintree.

PayPal is quite popular among freelancers as it is paid through systems and brings more and more money to accounts easily. If you are looking for a payment gateway that is easy and convenient for conducting more and more transactions then PayPal is the right option to choose. Moreover, when you end up offering a familiar gateway to your customers, they will come again and again to your store which ultimately results in a high return on investment. The price range might vary from 2.9 percent + $0.30 per transaction to 3.9 per cent + a fee depending on the currency required.

#3 Amazon Payments

The next leading payment gateway that seems to have gained the attention of several businesses is Amazon Payments. We all know Amazon is a huge platform built for online retailers and so is Amazon payments. Now this one is a hosted payment gateway that is well-integrated by using APIs. This particular payment gateway highly focuses on mobile payments as well as different payment methods including credit cards as well.

The price ranges from 2.9 per cent + $0.30 per transaction. International transactions are charged 3.9 per cent. Here there is no setting up or any kind of monthly fees.

#4 Authorize.Net

Now this payment gateway is the oldest one available across the globe. Since its inception in 1996, Authorize.Net seems to have a decent and well-established reputation. In fact, many people call this payment gateway the king of online payments as it offers great fraud protection, easy-to-use checkout opportunities, customizable integrations and subscription-based numerous features. Here you are bound to find a friendly interface and a $49 setup fee, paid only once with a $25 getaway fee, monthly, $25 chargeback fee, Transaction fee – 2.9% + $0.30 and so on.

Final Words

As mentioned earlier, payment gateways are many but what’s more important is to make the right choice. So whenever you choose a payment gateway, just make sure that it is PCI compliant, provides notifications on every single transaction made, stores customers’ payment information, provides high-level security, can be customized according to different needs, well integrated with tools such as accounting software or shopping carts, etc.

So I hope now you know exactly what needs to be done and how to choose the right payment gateway for your ecommerce store.

Vishal Shah works as an executive at TatvaSoft.com. He is responsible for new technology integrations in development projects. He prefers to share his valuable insights among the development audience by blogging.

Vishal Shah works as an executive at TatvaSoft.com. He is responsible for new technology integrations in development projects. He prefers to share his valuable insights among the development audience by blogging.

Vishal Shah works as an executive at TatvaSoft.com. He is responsible for new technology integrations in development projects. He prefers to share his valuable insights among the development audience by blogging.