7 Strategies That Are Proven to Reduce Involuntary Churn (And Help Win Your Customers Over)

Let’s say you’re an app developer. You’ve found your niche, built an original app that you just know people will love, optimized your marketing and discoverability plan, and have what you think is a fail-proof monetization strategy. But for some reason when it comes to product launch a high churn rate is killing your profit margin.

In the language of sales, customer churn rate is the percentage of customers that stopped using your company’s product or service during a certain period of time.

To calculate your churn rate, just divide the number of customers you lost during a certain stretch of time by the number of customers you had at the beginning of that time period. For example, if you started the quarter with 400 customers and ended it with 380, your churn rate would be 5% because you lost 5% of your customers.

What is involuntary churn?

No matter what product or service you sell, attracting potential customers and convincing them to part with their money is all well and good, but if for whatever reason they can’t finalize payment, you’ve lost a sale.

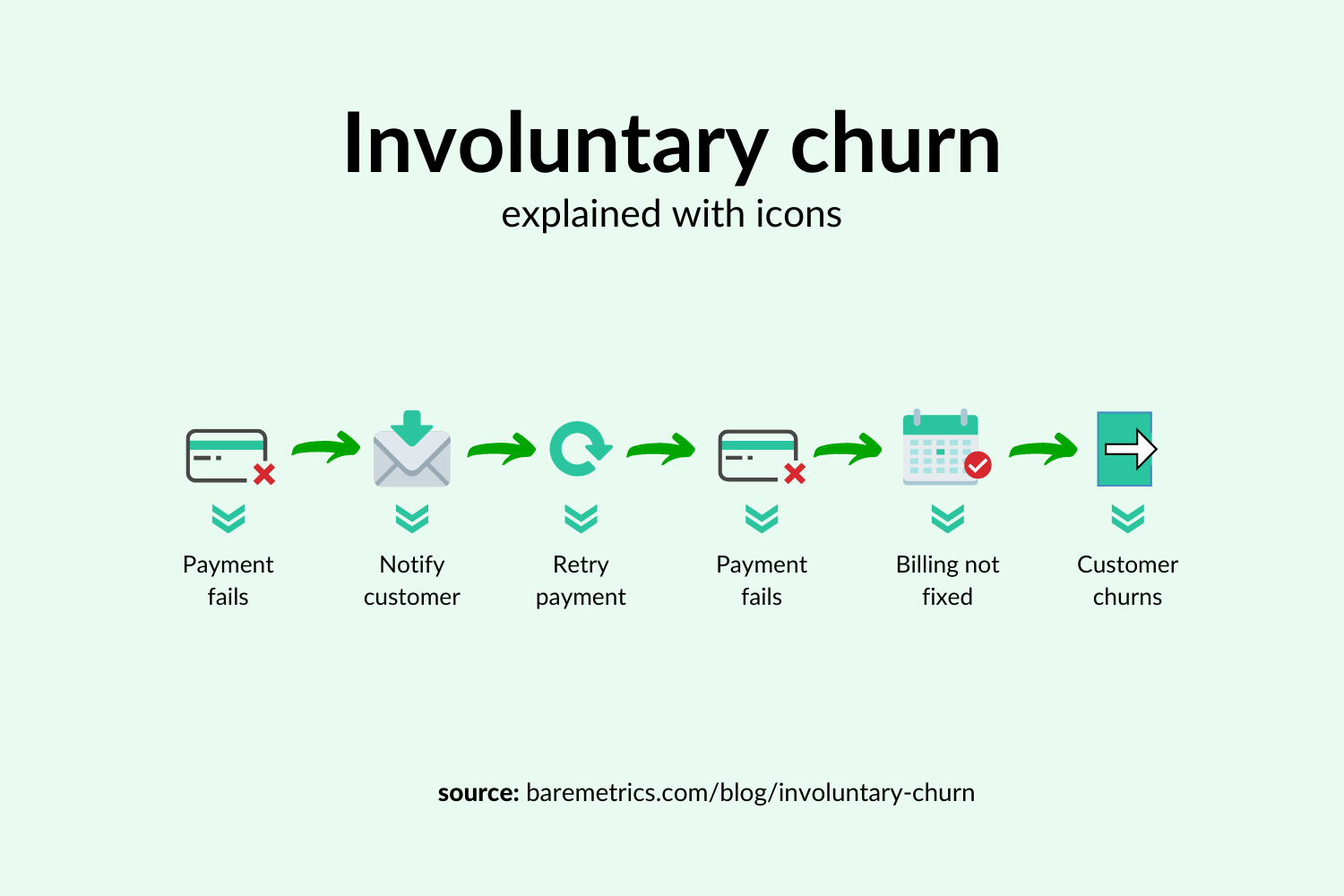

Involuntary churn is exactly this. It refers to when a customer is ready to make a purchase but some unforeseen difficulty prevents them from doing so.

Because we tend to think of churn rates as a metric that applies to existing customers, we often talk about involuntary churn as a feature of subscription services or business models that rely on repeat payment.

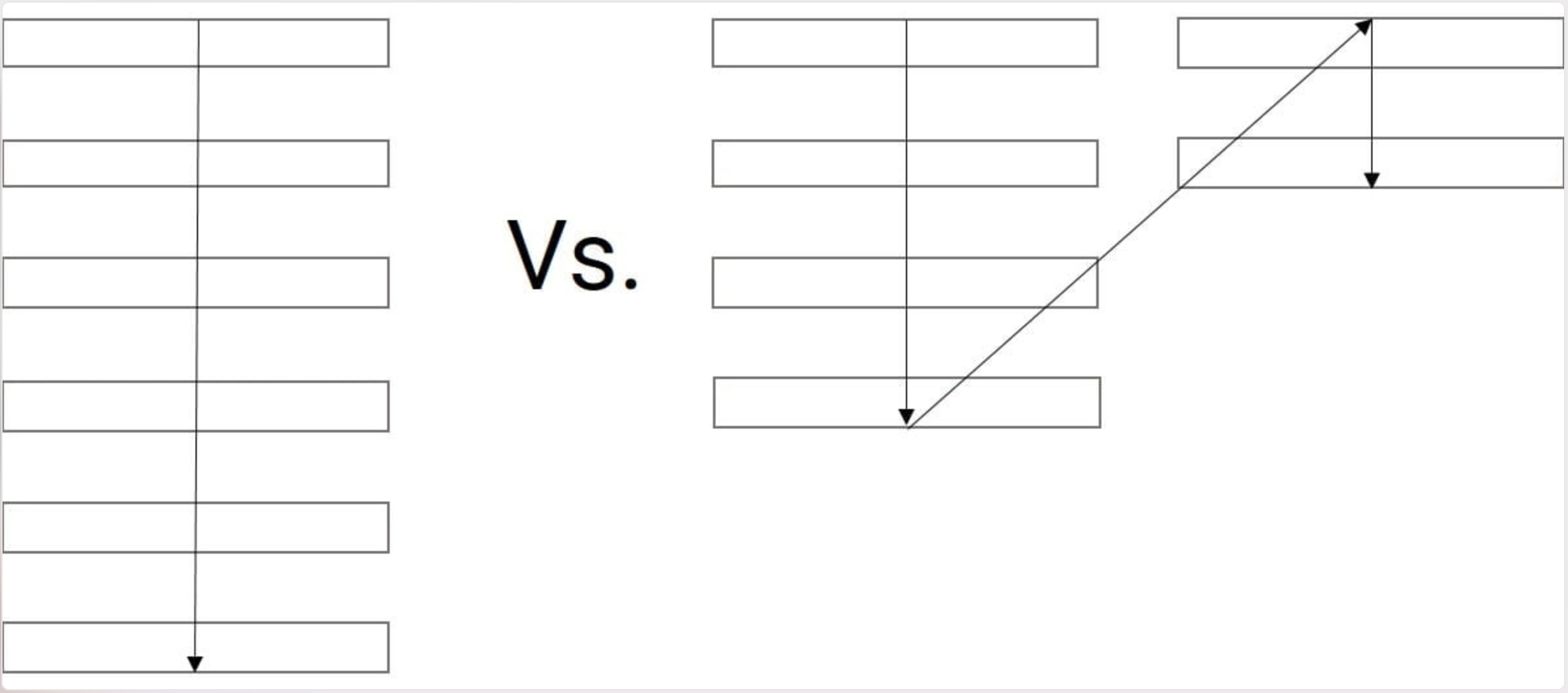

When analyzing your website’s traffic, it is useful to think about bounce rate vs exit rate in order to get a clear picture of which stage of the user experience people are leaving the site. The same logic applies to churn rates. When exactly in the customer lifecycle you are losing business is just as important as why.

1- Analyze what’s causing your company’s involuntary churn

When thinking about involuntary churn, the first thing you need to ask yourself is what’s causing the churn.

Are payments defaulting because of a problem with your payment gateway? Or is it an issue with your web design that’s causing the site to crash at the point of sale?

Different businesses will find that different things are causing customers to churn involuntarily. There’s no straightforward way to figure out what’s causing involuntary churn and ultimately it will take different types of testing to do so.

2- Apply best practices when sending dunning messages

Dunning is the process of methodically communicating with customers to ensure the collection of payments owed. It’s a simple but effective way of addressing involuntary churn that many businesses apply to the management of their repeat customers.

If you’re signed up for any repeat payments, subscriptions, or buy-now-pay-later services, you may have received dunning messages in the past. They typically take the form of an email or SMS sent if an expected payment hasn’t been processed for any reason.

If your dunning messages are accusatory or confrontational, you risk alienating the customer for good. After all, most failed payments can easily be rectified by customers simply re-attempting the payment or updating the payment details.

Ensure your dunning messages clearly explain what has happened, how the customer needs to proceed, and what the next steps are if they fail to make payment.

3- Use card updaters

For merchants who accept credit or debit cards for recurring charges, expired card numbers can be a leading cause of failed payments and involuntary churn.

Card updater services offer an alternative to trying to get in touch with customers on your own. In recent years, American Express and Mastercard have both accelerated innovation in the field and it’s now easier than ever to automatically update card details.

Compared to trying to get in touch individually, automatic card updaters help you to retain customers while saving time for everyone involved.

American Express offers a service known as Cardrefresher which allows merchants to keep customers’ Amex card details up to date. The service offers daily updates. Merchants can receive the updates directly or through a vendor or processor that updates their recurring billing or card-on-file data.

The Mastercard Automatic Billing Updater is a similar service designed to assist merchants in keeping their on-file card information current. In the Mastercard system, issuers submit account changes to Mastercard’s database, which merchants can access and use to update their own records.

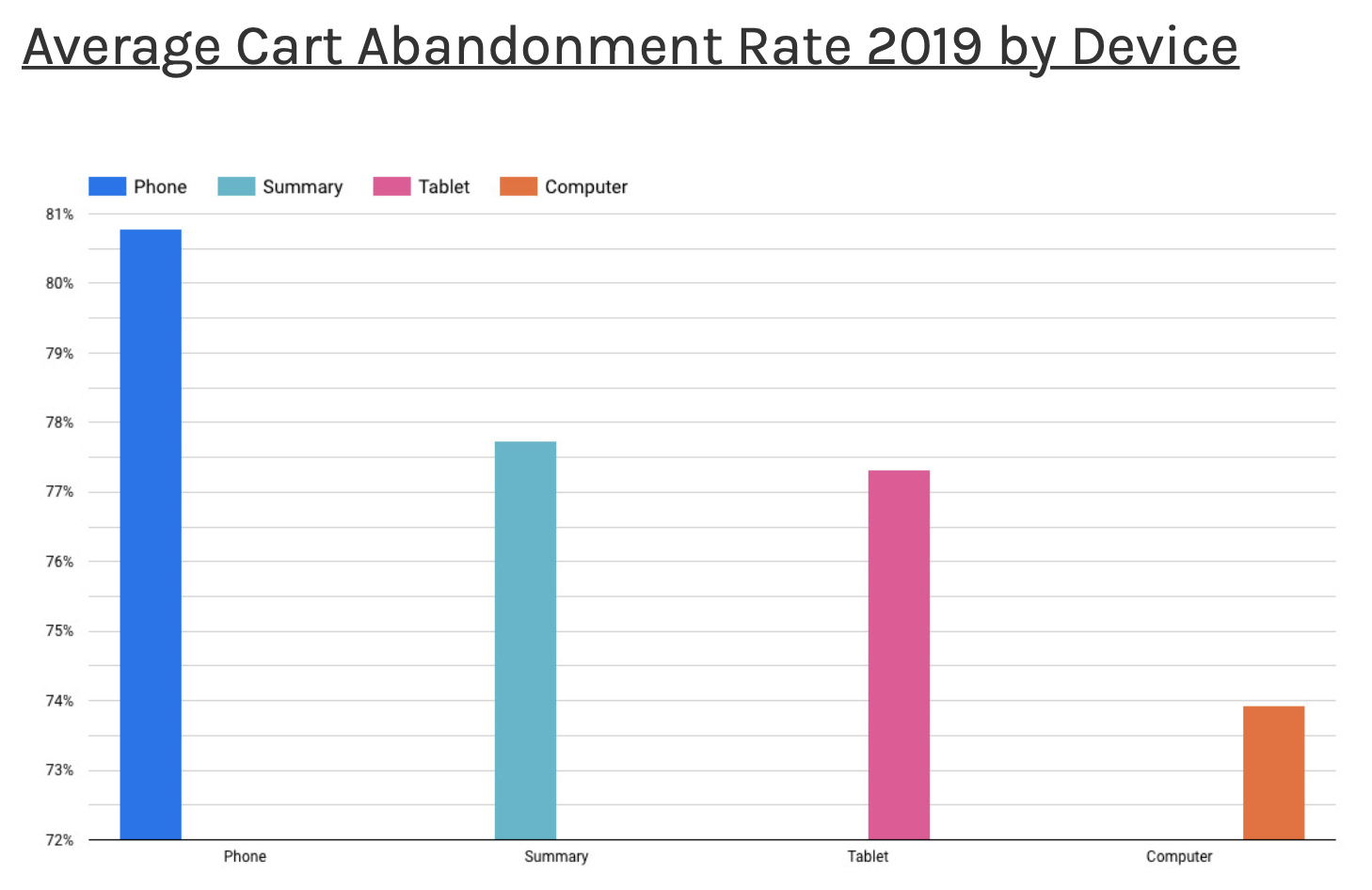

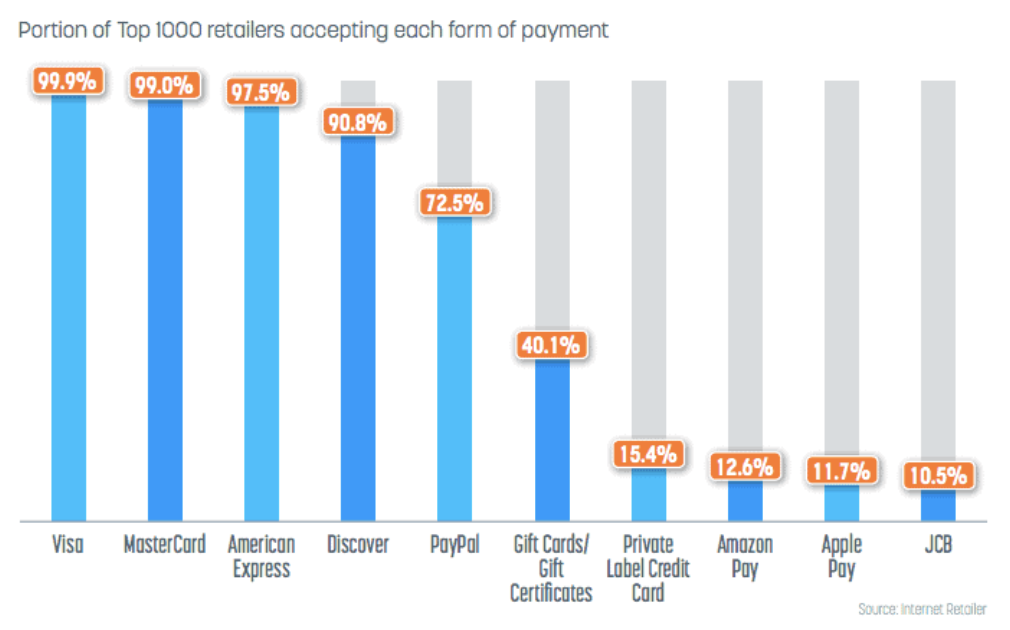

4- Offer multiple payment options

By multiplying the options for payment, and allowing customers to enter a backup option if one fails to process a payment, you increase the likelihood of successful payment and decrease your customer churn rate.

For truly global businesses, make sure you’re partnered with a payment gateway like PayTabs that supports multiple currencies. Nothing is likely to send customers elsewhere than not being able to pay in the currency of their choice.

5- Encourage direct debit for recurring payments

Direct Debit refers to when customers give their banks the authority to automatically pay recurring charges. It has been one of the most useful banking technologies for businesses that rely on these recurring payments. It is the preferred arrangement for paying utility bills such as gas and electricity and for subscription services such as SaaS business models.

In today’s international payment environment, the best way to get set up for direct debit payments is to enlist the help of a globally-minded payment gateway, that gives you access to the different technologies used to process direct debits around the world. For example, EG-ACH in Egypt or Masav in Israel.

Remember that direct debits can be used for both incoming and outgoing payments. As well as helping you to reduce involuntary churn by making repeat payments easy for your customers, it can be one of the best tools for affiliate marketing by helping you to pay your affiliates on time.

6- Optimize your retry cycle

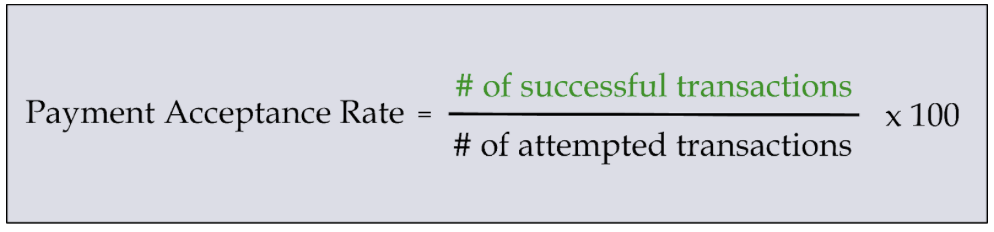

Businesses that rely on some form of electronic payment usually implement a retry cycle that automatically attempts to process a payment again when it fails.

Retry cycles are especially important in fields such as mobile eCommerce in which retailers are entirely dependent upon virtual payment methods.

When thinking about your retry cycle, it helps to divide declined payments into what are known as hard declines and soft declines.

A hard decline is when the issuing bank does not approve the payment. Causes of hard declines include:

- Stolen Card

- Invalid Card

- Closed Account

With hard declines, you often need to ask the customer to retry, usually with a different payment method.

A soft decline happens when the issuing bank approves the payment, but the transaction fails at some other point in the process. Typical reasons for a soft decline are:

- Processor Declined.

- Card Activity Limit Exceeded.

- Expired Card.

- The Purchase is Unusual.

- The Billing Address and the IP Address Do Not Match.

- The Card is Being Used Abroad.

For soft card declines, it is best to retry the payment at least once straight away. For hard declines, the ideal retry cycle is to retry again over the coming days or weeks. This gives people a chance to rectify the issue, for example by adding new payment details or funding their bank account if the card has insufficient funds.

7- Don’t cancel unpaid subscriptions

Some businesses automatically cancel unpaid subscriptions without giving the customer a chance to pay another way.

When there’s so much technology out there to help you collect repeat payments, even if your first attempt fails, canceling subscriptions without following up with your customers just doesn’t make sense.

Before canceling any subscriptions, first, you should find out why the subscription is going unpaid. For example, outsourced or inhouse testing might uncover an issue with your payment setup that is causing failed transactions that your customers don’t even know about. If this is happening, canceling the unpaid subscription would create a loss of revenue that could be avoided.

Conclusion

Whether your business model relies entirely on repeat payments, or a combination of payment types, reducing involuntary churn is a simple but effective way to increase your profits.

After all, a happy customer who continues to pay month-in month-out for a service they value is a great thing for any business. These types of customers can help you survive dips in growth and keep the revenue coming in when other sources dry up.

Emily Rollwitz – Content Marketing Executive, Global App Testing

Emily Rollwitz – Content Marketing Executive, Global App Testing Emily Rollwitz is a Content Marketing Executive at Global App Testing, a remote and on-demand app testing company helping top app teams deliver high-quality software, anywhere in the world. She has 5 years of experience as a marketer, spearheading lead generation campaigns and events that propel top-notch brand performance. Handling marketing of various brands, Emily has also developed a great pulse in creating fresh and engaging content. She’s written for great websites like Airdroid and Shift4Shop. You can find her on LinkedIn.

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman – Head Of Marketing, Global App Testing

Matthew Cooper – Marketing Automation & Operations Manager, Global App Testing

Matthew Cooper – Marketing Automation & Operations Manager, Global App Testing

Jessica Day – Senior Director, Marketing Strategy, Dialpad

Jessica Day – Senior Director, Marketing Strategy, Dialpad

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad

Jenna Bunnell – Senior Manager, Content Marketing, Dialpad