Digital, Social and Payment Orchestration Solutions to Grow your Business

Manage your business with secure, omni channel payment solutions built to help you sell your products and services around the world.

Digital, Social and Payment Orchestration Solutions to Grow your Business

Manage your business with secure, omni channel payment solutions built to help you sell your products and services around the world.

Digital, Social and Payment Orchestration Solutions to Grow your Business

Manage your business with secure, omni channel payment solutions built to help you sell your products and services around the world.

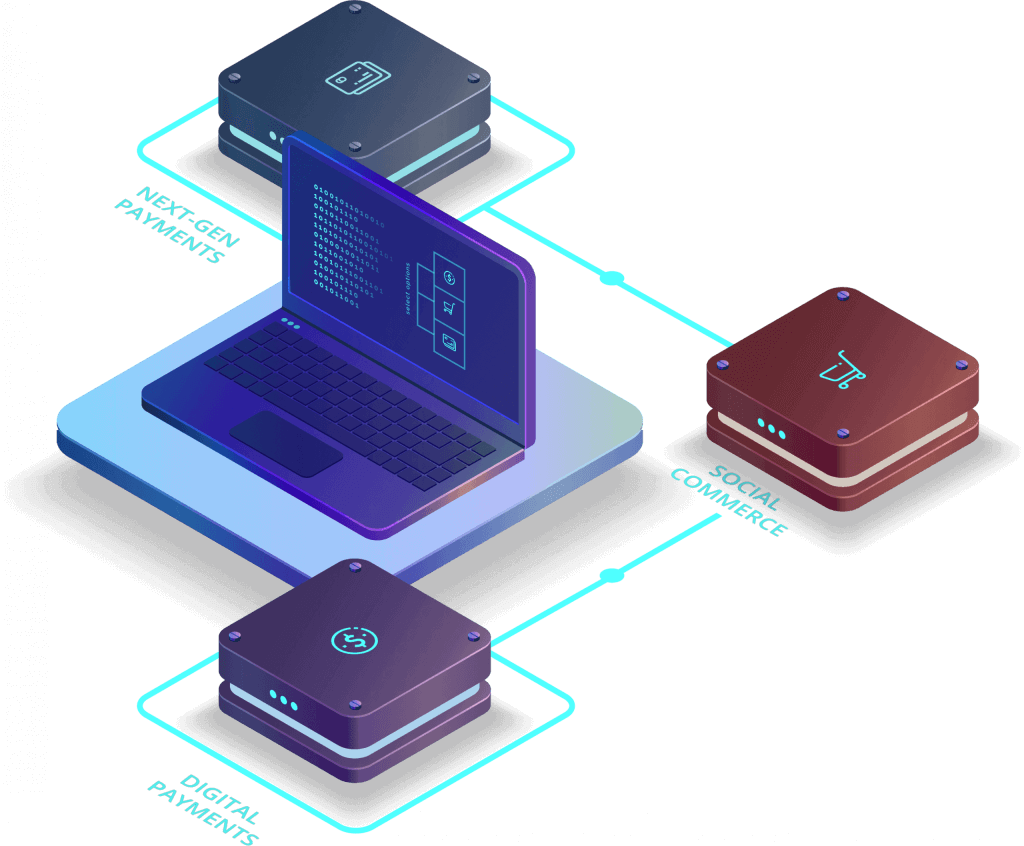

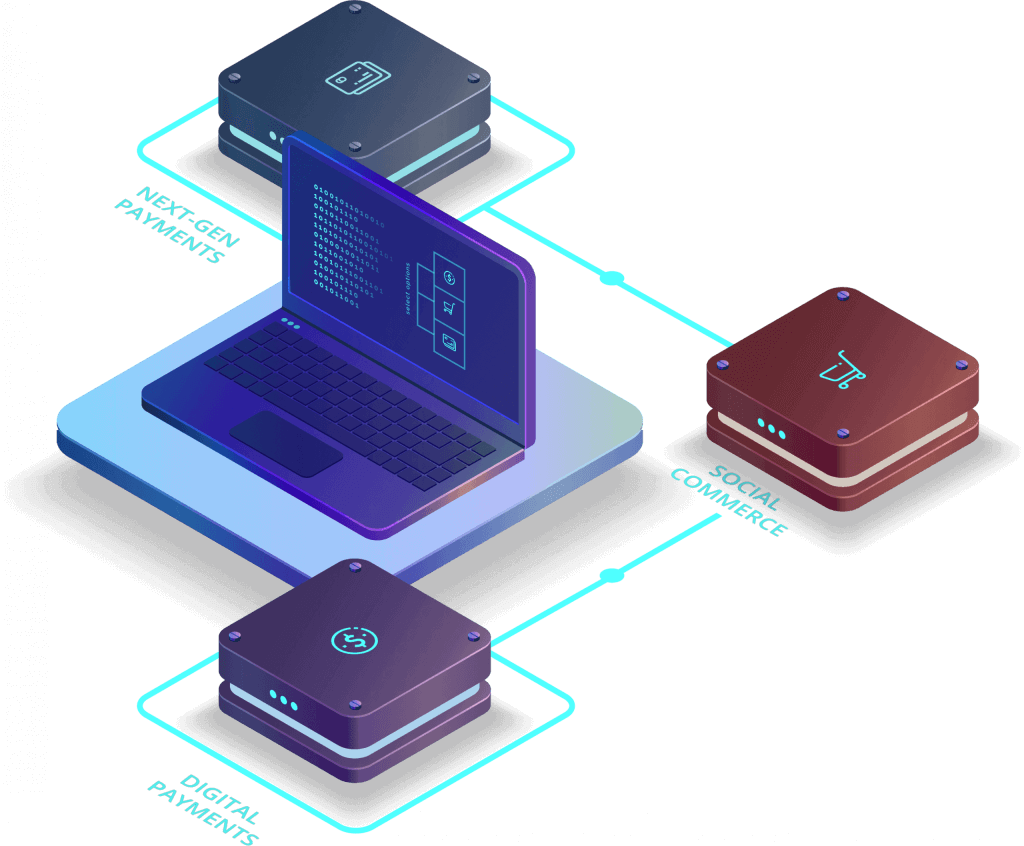

Digital Payments

As an ecommerce business owner, find everything needed to integrate your website or mobile app.

Social Commerce

Freelancer ? Turn your passion to profit and get paid in seconds with Paymes social media links.

Payment Orchestration

Product and intellectual property stack for banks, financial institutions and fintechs.

Digital Payments

As an ecommerce business owner, find everything needed to integrate your website or mobile app.

Social Commerce

Freelancer ? Turn your passion to profit and get paid in seconds with Paymes social media links.

Payment Orchestration

Product and intellectual property stack for banks, financial institutions and fintechs.

Digital Payments

As an ecommerce business owner, find everything needed to integrate your website or mobile app.

Social Commerce

Freelancer ? Turn your passion to profit and get paid in seconds with Paymes social media links.

Payment Orchestration

Product and intellectual property stack for banks, financial institutions and fintechs.

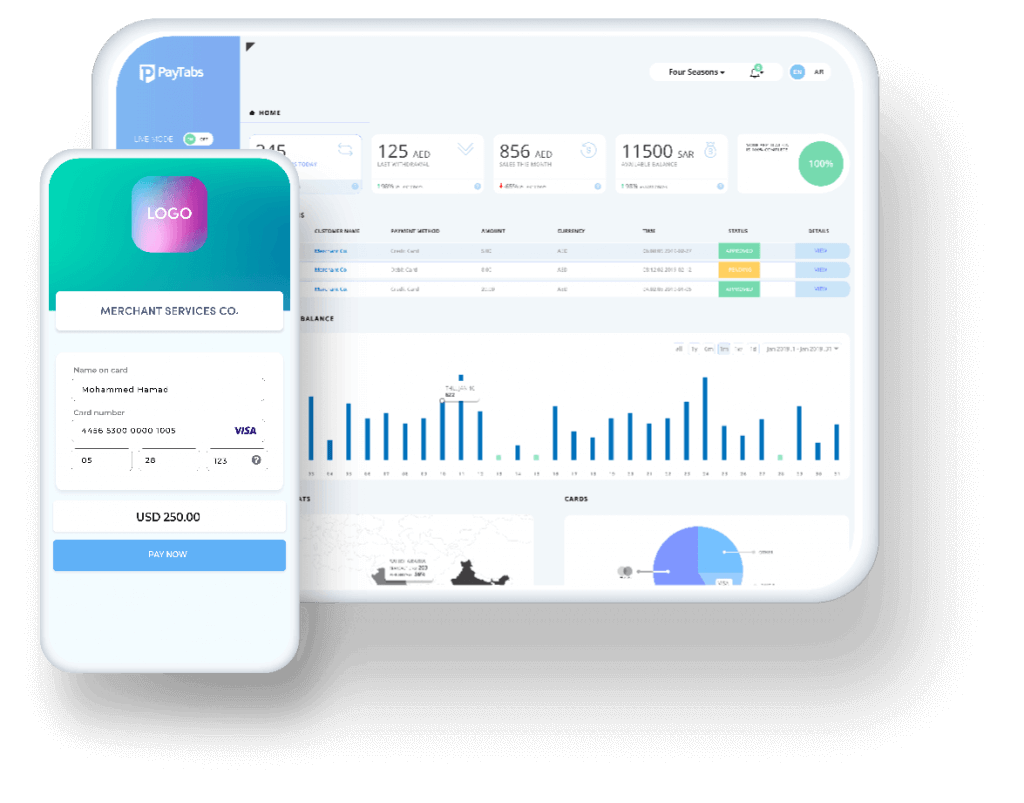

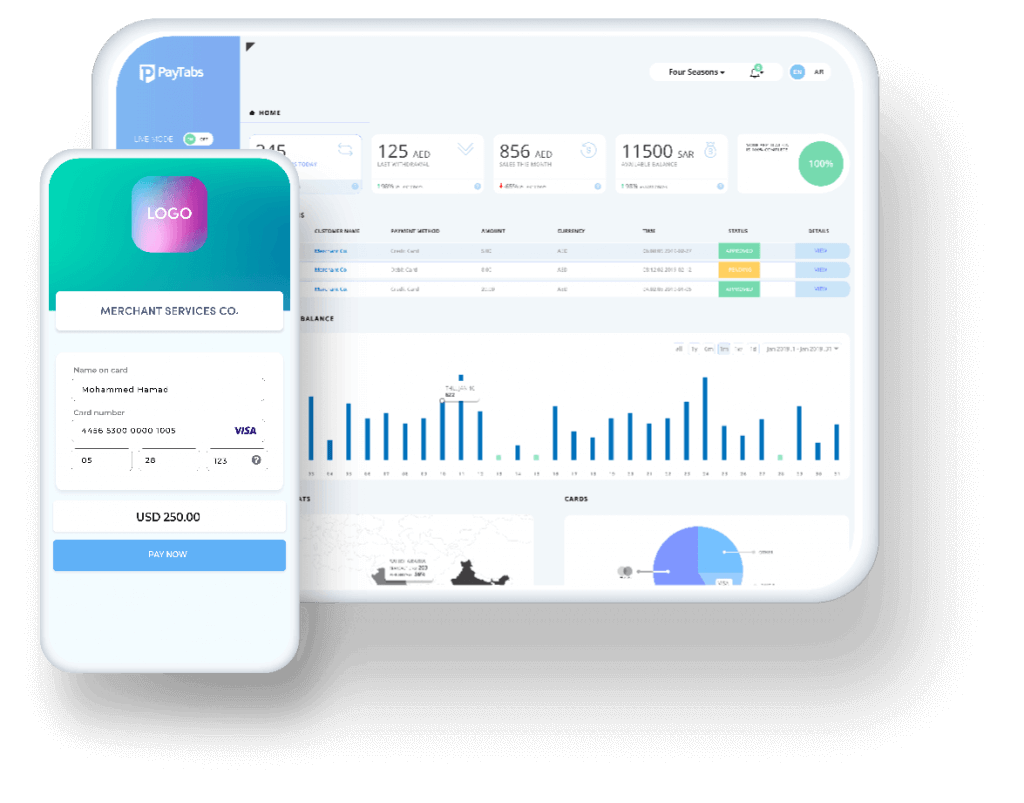

Payment Gateway Platform

Start, build, and grow your e-commerce business with our secure payment solutions. Integrate PayTabs with your website or mobile app to expand your digital business footprint.

Payment Gateway Platform

Start, build, and grow your e-commerce business with our secure payment solutions. Integrate PayTabs with your website or mobile app to expand your digital business footprint.

Realtime Onboarding

PayTabs ‘one click’ onboarding process and simple documentation makes it easier to start selling globally, in hours.

Powerful Merchant Dashboard

Send, receive and share invoices via QRcode , Email, SMS, Whatsapp or social media channels. Track your orders and measure your sales revenue in real-time.

Multiple Payment Options and Currencies

From local and international credit cards and debit cards to digital wallets, our platform empowers every shopper on your checkout page with their favorite payment option.

Realtime Onboarding

PayTabs ‘one click’ onboarding process and simple documentation makes it easier to start selling globally, in hours.

Powerful Merchant Dashboard

Send, receive and share invoices via QRcode , Email, SMS, Whatsapp or social media channels. Track your orders and measure your sales revenue in real-time.

Multiple Payment Options and Currencies

From local and international credit cards and debit cards to digital wallets, our platform empowers every shopper on your checkout page with their favorite payment option.

Social Commerce by Paymes

Start that freelance business you have always been passionate about. Set up your own digital store window on the Paymes platform, list your products and start selling immediately.

Social Commerce by Paymes

Start that freelance business you have always been passionate about. Set up your own digital store window on the Paymes platform, list your products and start selling immediately.

Pay by Link

Collect your freelancer fees or payments by creating and sharing a social media link.

Pay by QR code

Get paid for your gigs via a unique QR code.

Open your Online Shop

With Paymes, you can set up your online store front in 3 minutes!

Pay by Link

Collect your freelancer fees or payments by creating and sharing a social media link.

Pay by QR code

Get paid for your gigs via a unique QR code.

Open your Online Shop

With Paymes, you can set up your online store front in 3 minutes!

Payment Orchestration Solutions

Cutting edge tech stack that is secure, scalable, and stable to handle small and large volumes of payment processing. Solutions can be delivered on cloud, on premise or hybrid model, anywhere in the region.

Payment Orchestration Solutions

Cutting edge tech stack that is secure, scalable, and stable to handle small and large volumes of payment processing. Solutions can be delivered on cloud, on premise or hybrid model, anywhere in the region.

Routing and Authorization

Master Switching Technology with support for popular schemes.

E-Commerce Suite

White Labelled solutions to expedite the launch of your online business.

Cards and Wallet Management

Virtual and Physical Cards Issuing Solution.

Routing and Authorization

Master Switching Technology with support for popular schemes.

E-Commerce Suite

White Labelled solutions to expedite the launch of your online business.

Cards and Wallet Management

Virtual and Physical Cards Issuing Solution.