9 Tips For Boosting Your Payment Acceptance Rate (That Will Surely Improve Customer Experience)

Posted on

Scopophobia is the fear of being stared at. We’ve all experienced this before. Picture the scene: you’re standing in front of the queue in a busy shop, trying to hurriedly pay for your items. Then come the dreaded words on the card machine: PAYMENT DECLINED.

Well, this problem is not limited to brick-and-mortar stores. If you’ve ever run an online store you will know that transaction errors are pervasive.

And whilst online transaction failures might not induce scopophobia, they are certainly frustrating for businesses and customers alike. In Europe alone, e-commerce transaction failures cause an estimated annual €82 billion loss for businesses.

Understanding why payments fail will put your business in a stronger position to retain willing customers. In this article, we’ll show you how to calculate payment acceptance rate, and our top tips for improving it.

What is payment acceptance rate?

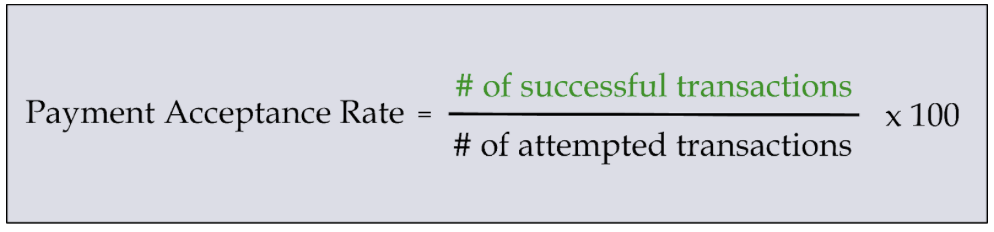

Payment acceptance rate is simple to calculate. You only need to know the number of successful transactions compared to the number of attempted transactions.

But what is a good payment acceptance rate?

The answer to that question depends entirely on the context of your business. Generally speaking, you’ll want to aim for an 80% acceptance rate at least.

Why? It’s one of the key test execution metrics for assessing the customer conversion rate of your online store. After all, if you can’t accept payment from customers, then you can’t do any business with them.

(image created by writer)

Why do some payments fail?

Unfortunately, there’s not a simple answer to that question. It may be for lack of funds in the customer’s bank account. Perhaps they incorrectly input their details on your payment form. Or it could be that your acquiring bank hasn’t allowed the transaction (we’ll get to that later).

That is not to say that your business cannot take steps to reduce failed transactions. In this article, we’ll outline 9 tips for remedying this problem.

What can you do to boost payment acceptance?

Create the perfect checkout

Once your customers have reached the checkout page, the decision to buy a product or service will have already been made.

Now all that’s left is to ensure the customer’s payment goes smoothly. If it fails the first time, the likelihood is that they’ll lose patience and willingness to try again. In fact, online merchants lose 62% of customers after the first failed transaction.

In the competitive world of online commerce, there is a firm expectation that your checkout is free of barriers or complications. So, let us share our top tips for achieving this:

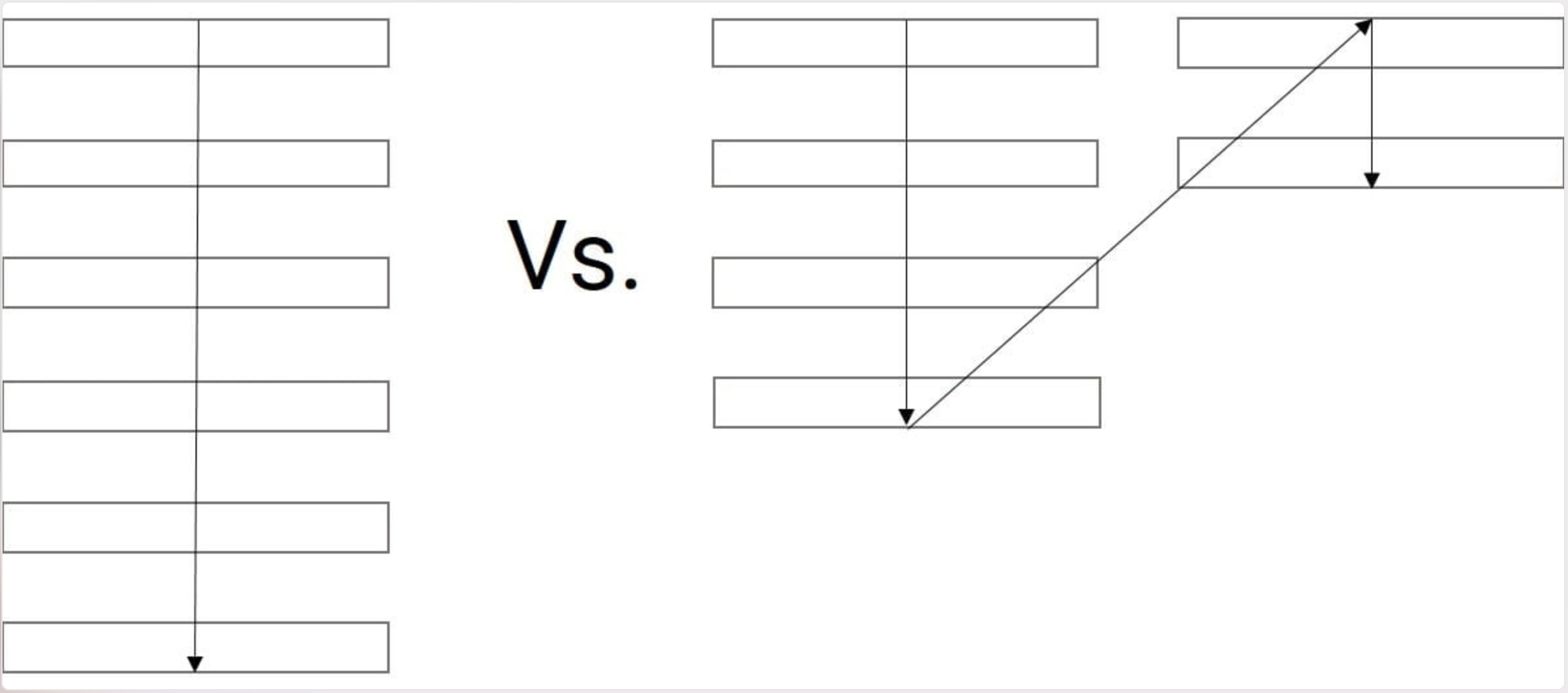

Stick to simple

Above all, your checkout needs to be intuitive. Overwhelming your customers with a plentitude of forms and menus is a no-go. A CXL study found single-column forms were filled out on average 15.4 seconds faster than multi-column forms. In short, simple checkouts are faster, meaning a higher conversion rate for your business.

Focus on the information you need by limiting the number of fields and indicating the optional ones. Lastly, arrange your payment form so the most time-consuming fields are at the bottom. Once the easy part is done, your customers will happily follow through with the rest.

Focus on user-friendliness

Now the basics have been covered, you’ll want to make a few accessibility improvements. It’s essential that your customers feel cared for and appreciated. Minor changes like showing the total cost at each step will help eliminate doubts about payment.

An often-overlooked addition is the humble progress bar. This visual reminder will assure your customers that finalizing their payment is just a few clicks away.

You may also want to add an auto-complete feature. For example, the customer inputs their zip code, and your checkout fetches the full address for them. Any mechanism for saving time and effort will push up that coveted customer conversion rate.

Reduce waiting times

Online commerce is all about convenience. If a page takes too long to load, there is a very real risk that your customers will leave and never return. According to LoadStorm, even a 1-second delay reduces customer satisfaction by 16%.

As such, it’s imperative that you regularly test your site’s loading screens. If load times are excessive, you may need to declutter problematic pages or avoid linking to external sites.

This principle applies far beyond the checkout page of your online store. Customers will quickly become irritated if they feel that your customer service responds in inadequate time. Building a team structure that responds to high-priority inquiries will mitigate this concern.

Fail to do this? You’ll test your customers’ patience and ultimately risk losing their business.

Offer delivery information

For goods that require delivery, every customer’s question will be: when?

The convenience of online shopping is deeply diminished if that question has the answer: not for a long time. Therefore, the best online stores will focus on achieving fast delivery times, then advertising that fact to their customers.

Investing in a solid inventory tracking system can help with calculating delivery costs and times at an earlier stage. This will boost customer confidence before they reach the checkout, helping to drive up sales.

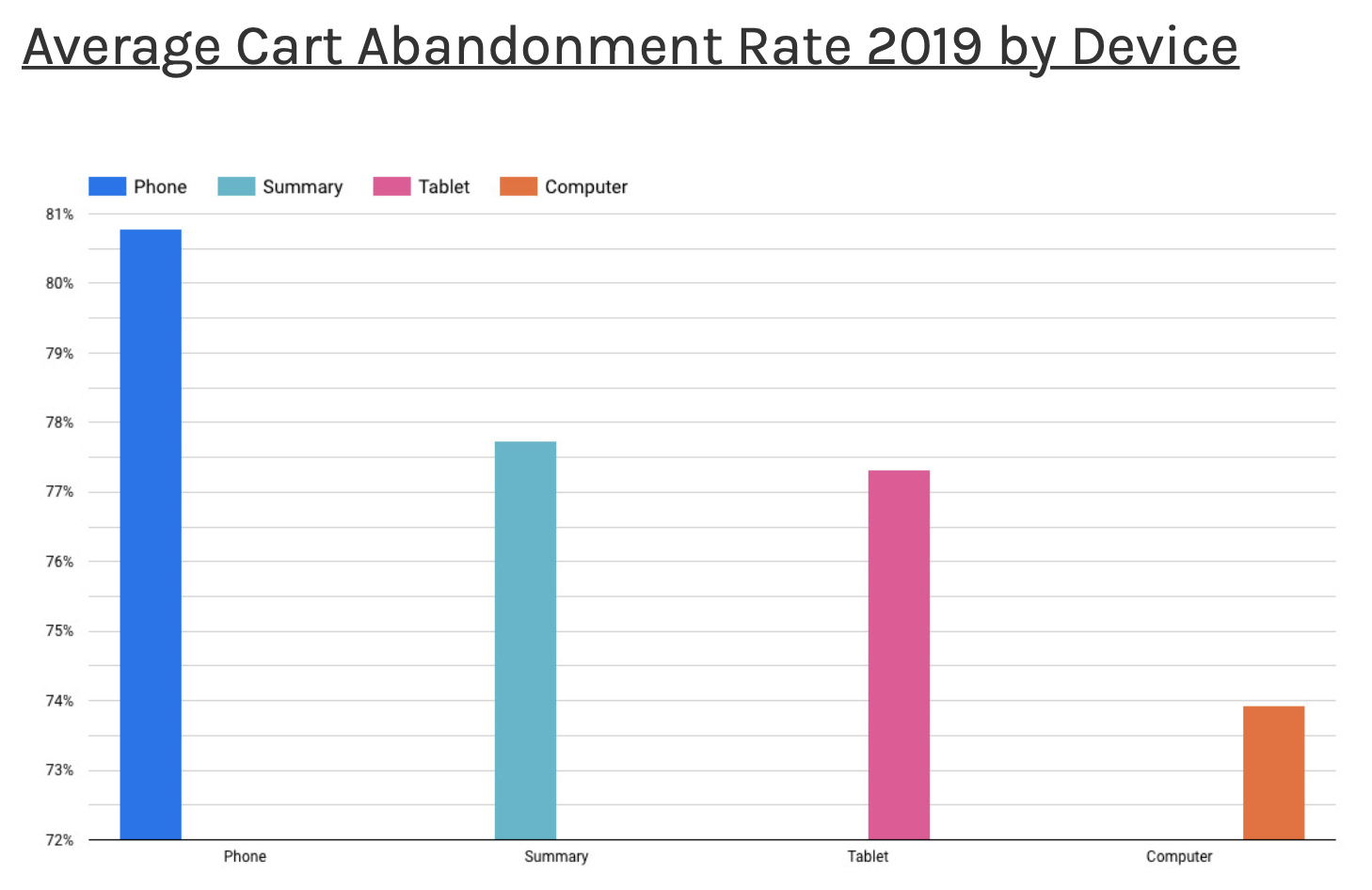

Don’t forget mobile UX

Since 2016, the majority of e-commerce sales have come from users on mobile devices. Today mobile users have a 72.9% market share of the industry.This has allowed businesses to accept payment from billions of people across the world. However, it has also come with its own drawbacks. One such challenge is that mobile customers are more likely to abandon their shopping carts.

For this reason, it’s more important than ever to build a checkout that is mobile-responsive. Mobile website checkouts should be cross-channel, appearing largely similar to the desktop version.

You may even consider developing a mobile app for your online store. App checkouts will foster higher conversion rates and customer loyalty over their site-based equivalents.

Choose the right acquirer

If you run an online store, you’ll have to find an acquiring bank to process card transactions on your behalf. The acquirer is responsible for communicating with the customer’s bank before a transaction can be made.

This is the point at which many transactions fail, either because the acquirer cannot authorize or authenticate the payment. As such, choosing the right acquiring bank is an important decision for any online store to make. Factors you should consider include:

Geolocation of your customer-base

Firstly, you must think about where in the world your customers are based. Different acquirers will offer support for local languages, currencies, and payment methods.

If most of your customers are from the EU, you’ll want to partner with a European acquiring bank that is adapted to local regulations. For example, they’ll follow adequate risk assessment procedures (such as 3D-Secure verification) to ensure compliance.

Conversely, if you have an international customer base, you may consider partnering with a single payment provider. This can save you the money and headache of trying to select multiple acquirers for different regions.

Tokenization

Another consideration is to look at which services offer ‘tokenization’. This is a way of saving your customer’s payment data so that it may be automatically filled in on future visits.

There are many advantages to using tokenization. Namely, lower costs and improved security. It’s cheaper for your business as PCI compliance will be accounted for by your payment partner. It also encrypts your customer’s data and prevents it from being stolen by fraudsters.

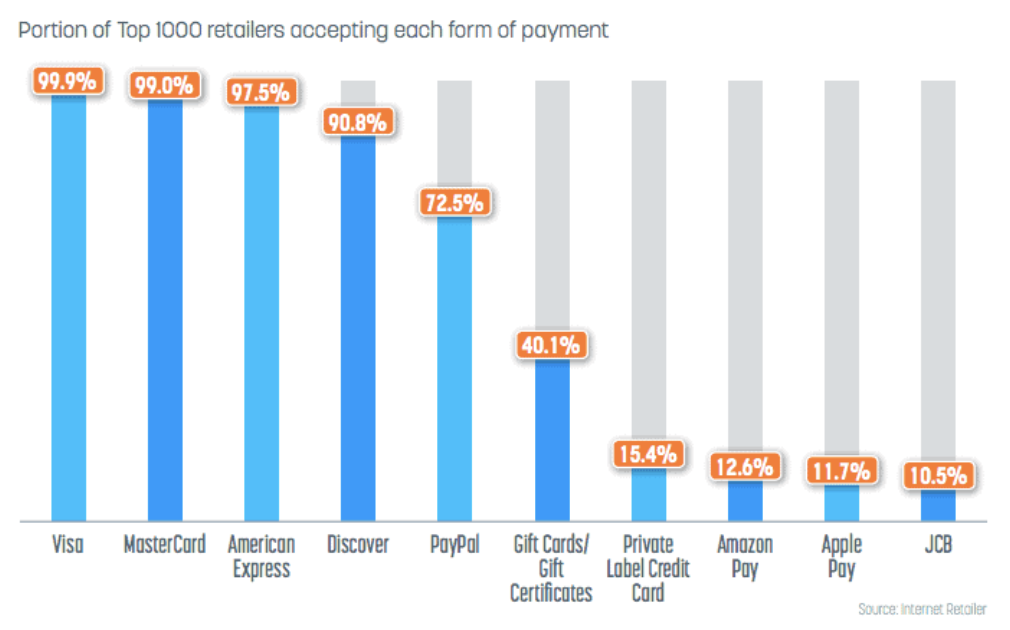

Accept different payment options

Offering alternative payment options is an attractive method of enticing customers from around the world. Visa and MasterCard are standard in online commerce, and you must accept these forms at the very least.

Increasingly however, online stores are accepting PayPal or mobile payment options from customers. Mobile apps are particularly easy to integrate with Apple Pay or Google Pay. The convenience of pressing a single button to make a payment cannot be understated. It offers a far more timely result for the customer than filling in an entire payment form.

Of course, you may notice that problems arise more often using certain payment methods than others. In this case, you may find using regression testing services helps identify the root cause.

Communicate with your customers

Failed payments are part and parcel of online commerce, even if you follow every precaution on this list. That does not mean to say that all hope is lost. Often, reaching out to your customers after a failed attempt will prompt them to try again.

Having systems in place to automatically detect and respond to failed transactions will surely improve your customer conversion rate. This could be a simple follow-up email, or invitation to talk via voice over IP intercom.

Of course, the result will come down to the individual case. Generally speaking though, the faster you attempt to communicate, the greater the chance of success.

Conclusion

This article was written to help you understand the many facets of payment acceptance. By now you should have a good idea of why payments fail, and how to remedy those cases. Following the tips outlined above should assist in increasing customer conversion rate on your online store.

Kate Priestman – Head Of Marketing, Global App Testing

Kate Priestman – Head Of Marketing, Global App TestingKate Priestman is the Head of Marketing at Global App Testing, a trusted and leading end-to-end functional testing solution for QA challenges. Kate has over 8 years of experience in the field of marketing, helping brands achieve exceptional growth. She has extensive knowledge on brand development, lead and demand generation, and marketing strategy — driving business impact at its best. Kate Priestman also published articles for domains such as VMblog and Stackify. You can connect with her on LinkedIn.