Middle East Payment Services partners with Saudi Arabia’s PayTabs Group

Posted on

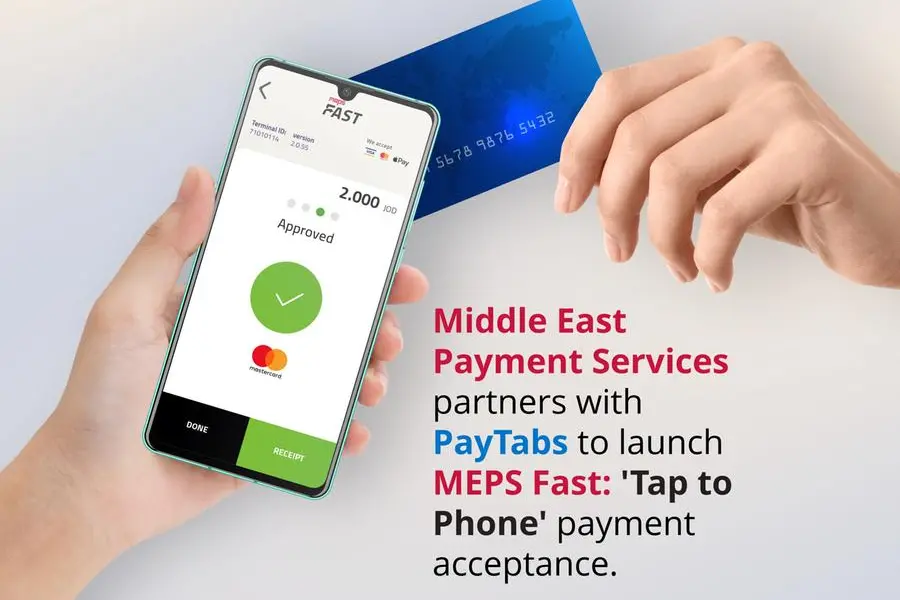

- MEPS Fast transforms smart phones into merchant point of sale (POS) terminals enabling businesses in Jordan to benefit from contactless payments.

Amman, Jordan – Middle East Payment Services, the Jordan’s most innovative payment service provider today announced its strategic collaboration with PayTabs, Saudi Arabia’s award-winning payments powerhouse to launch the latest version of the ‘Tap to phone’ soft POS application: MEPS FAST.

‘Tap to phone’ facilitates secure contactless payments from small businesses in retail, tourism, leisure, delivery and logistics, entertainment, hospitality, food and beverage. A breakthrough innovation by Arabia’s PayTabs in Levant’s fintech space, soft POS enables retailers, boutiques, kiosks, delivery companies and other small businesses to accept contactless payments via their smart phones. The MEPS Fast mobile app transforms merchants’ personal Android phones into high-speed point of sale terminals, enabling seamless acceptance of contactless payments from NFC enabled MasterCards and Visa cards.

According to Statistica, the Digital Payments market in Jordan is projected to grow by 14.13% from 2023 up to 2027 resulting in a market volume of US$12.25bn in 2027. In January, the Central Bank of Jordan (CBJ) allowed all e-payment companies and banks operating in the Kingdom to set a new ceiling for contactless payments – one transaction should not exceed JD100 and the total value of transactions per day should not exceed JD300. Contactless payments in Jordan witnessed a boom after the Central Bank, in late 2020, obliged all banks and e-payment companies not to issue cards or use points of sale (POS) devices that do not support contactless features. In fact, contactless payments made in 2022 represent 37% of the total value of e-payments in Jordan. With this promising market growth, thousands of merchants will now be able to rely purely on contactless software-based solutions to accept payments. MEPS Fast aims to penetrate new merchant segment and replace where applicable physical POS devices.

For Jordanian retailers, the key advantage of soft POS over traditional POS machines is that the MEPS Fast app does not require additional hardware. Once downloaded the solution will be available to retailers round the clock, facilitating digital payments at any hour. MEPS Fast also supports the ‘PIN on Glass’ feature so the PIN entry will be made directly on PCI certified touchscreen payment devices.

As an added benefit for retailers, MEPS also announced a collaboration with Huawei to purchase discounted Android devices that may be paid in 12 easy monthly installments at 0% interest. The discounted price on the devices will be exclusive for MEPS merchants in Smart Buy.

Mr. Ali Abdel Jabbar, CEO of Middle East Payment Services Company, said:” The launch of the newer version MEPS Fast is a reinforcement of the company’s slogan “Powered by Innovation,” which distinguishes MEPS from other competitors in Jordan through its continuous deployment of the latest solutions. This unique service is in line with the company’s vision towards achieving financial inclusion in Jordan and expanding our customer base of merchants, with the focus on small and medium-sized companies such as home delivery, transportation, and distribution companies.”

Eyad Musharbash PayTabs’ Regional General Manager for Levant & Southern Gulf concluded, “Facilitating secure digital payments is a game changer in Levant’s payments landscape. We are excited to once again partner with MEPS to bring innovative, low-cost acceptance solutions that meet the evolving payment needs of small businesses in Jordan. The convenience, security, and ease-of-use provided by MEPS Fast will undoubtedly boost businesses’ capabilities while enhancing consumers’ payment experience.”

About PayTabs

The PayTabs Group is an award-winning payments solutions powerhouse founded by Saudi entrepreneur Abdulaziz Al Jouf.

Having processed the first live payment gateway transaction in 2014, today PayTabs processes transactions in multiple currencies and markets, swiftly and securely. By providing the infrastructure for B2B payment solutions, including digital invoicing for businesses, QR code, social media payments, point of sale and switching platforms, PayTabs facilitates seamless e-commerce and social commerce solutions for merchants and super merchants.

Over a decade, PayTabs has custom built and exported a full stack of game changing solutions. These include mobile applications, hospitality, governmental, education, airline, travel, transport, and biller solutions, to interlink the multi-billion-dollar enterprise market chain in the region.

In 2021, PayTabs launched PT Touch, the first soft POS solution in the MENA market to transform smart phones into merchant point of sale (POS) terminals. In 2022, PayTabs made a leapfrog move to pioneer next generation payments, by launching its home owned, globally validated unified payments and transaction processing platform –PayTabs SwitchOn®. PayTabs unified payment processing orchestration enables governments and large-scale originations to become independent payment platforms to serve their industries.

In 2022, the company acquired Türkiye’s social commerce platform Paymes to complement its existing retail portfolio. In early 2023, PayTabs received payment gateway certification from Saudi Payments.

PayTabs has dedicated offices in the GCC including the UAE & Saudi Arabia and presence in many other locales including Jordan, Turkey, and Egypt. The company is an equal opportunities employer with a multi-cultural team. For more milestones visit https://site.paytabs.com/en/ MEPS

MEPS is a payment partner that bridges the interaction between consumers, merchants, and financial institutions, introducing change and innovation to shape the way of life and daily habits from cash to digital currency in parallel with changing customer behaviors and developments in the field of financial technology, by providing safe, flexible, and reliable solutions that meet diverse payment requirements.

Middle East Payment Services (MEPS) is an innovative regional payment services provider, offering a wide range of secure payment solutions, including industry-leading payment processing capabilities, digital wallets and online cash solutions, mobile applications, unique merchant services, and ATM management. In addition to a comprehensive range of customized value-added services that meet the growing demand for payment solutions throughout Jordan, Palestine, and Iraq.

MEPS offers a comprehensive range of services that enhance payment services for banks and other businesses, as well as providing unparalleled security to consumers across the region.

View full release on:

zawya.com

ibsintelligence.com

thefintechtimes.com

ffnews.com

tradingview.com

meretailnews.com

paymentexpert.com

regtechafrica.com

cxoincmagazine.com

fintec.tech