Explaining Frictionless Payment And Its Impact on Digital Business

Posted on

In the digital age, customers expect a smooth and stress-free payment experience.

Unfortunately, too many businesses get it wrong regarding the checkout process, often leading to cart abandonment.

Recent research suggests that average cart abandonment across all industries is 69.82%. However, adopting a frictionless payment strategy could be the key to decreasing cart abandonment and boosting conversions.

This short guide will explain frictionless payment and its impact on digital business.

What exactly is frictionless payment?

Frictionless payments simplify the buying process so that minimal effort is required during transactions. In other words, there’s less potential friction involved.

A frictionless payment process should fulfill these criteria:

- Reduce checkout waiting times.

- Optimized checkout process with minimal steps required for completion.

- Intuitive experience that’s easy for the customer and seller to use.

- Reduces frustrating aspects such as remembering pin codes.

Frictionless payments are on the rise; common uses include mobile payments (mobile can also be used for mobile invoicing), digital wallet payments, contactless payments, one-click payments, and auto-renew subscription payments.

What is the impact of frictionless payment on digital business?

The digital transformation has improved many business processes by making them efficient and stress-free. From ad hoc testing in software development to API legacy systems in insurance industry, there’s a tech solution for most processes.

Frictionless payments are the same. Keeping customers satisfied with an optimized payment process could lead to increased conversions and lower cart abandonment. It’s a win-win for everyone involved– the buyer and the seller.

Here are some ways frictionless payments help businesses.

Decrease cart abandonment

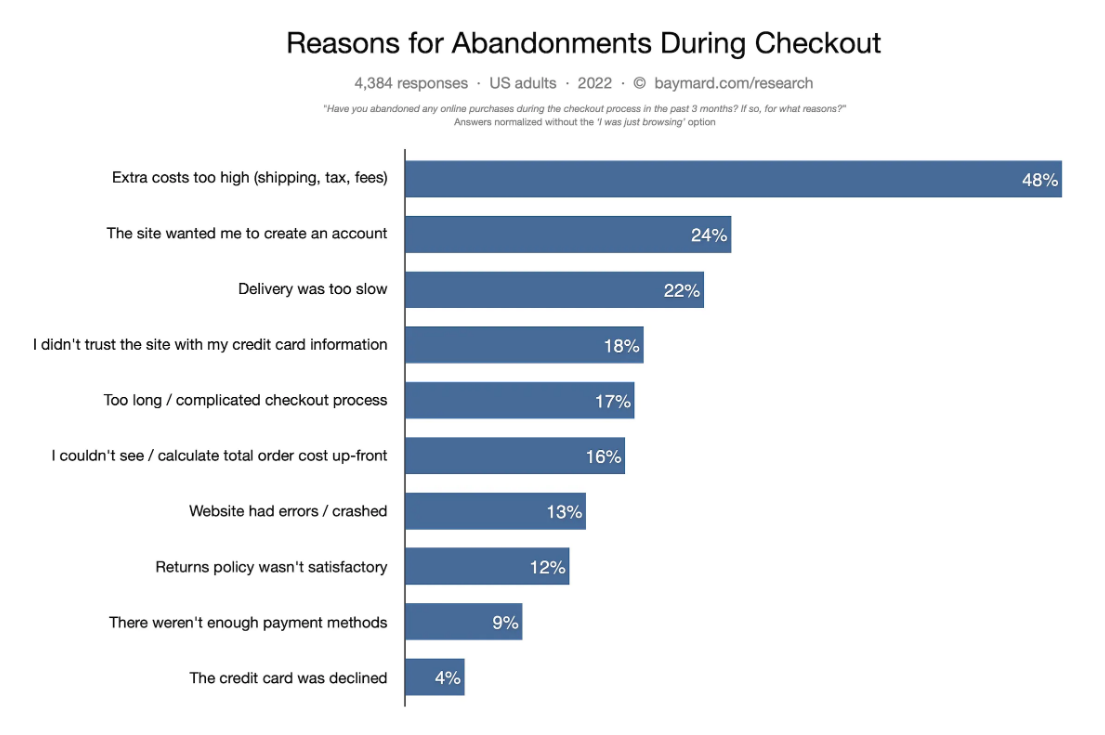

In 2021, 81.08% of website users abandoned their carts in retail, fashion, travel, and utilities. A time-consuming and complicated checkout process is often the reason customers get frustrated and leave.

Luckily, frictionless payments keep the whole process smooth and hiccup-free to prevent cart abandonment.

Increase customer satisfaction

Frictionless payments help keep customers satisfied throughout the checkout process by reducing the input required.

No one wants to be asked repeatedly to input their details for a repeat order. Have customers who need to renew their subscription? These things shouldn’t slow the customer down. Frictionless payment methods like auto-renew and auto-fill make it light work for both parties.

Greater Security

Protecting yourself online is important, and digital payments can help.

Not only do online sellers no longer need access to your bank card, digital frictionless payments come with a unique digital signature making them more secure.

This goes one further for iOS and Android users who have the option to use a fingerprint for added security.

PayTabs frictionless payment service

PayTabs’ SwitchOn® platform offers unrivaled capabilities, value, and flexibility to established financial institutions, Fintech’s and merchants in the MENA region.

Find out how PayTabs can help you here.

Emily Rollwitz – Content Marketing Executive, Global App Testing

Emily Rollwitz – Content Marketing Executive, Global App TestingEmily Rollwitz is a Content Marketing Executive at Global App Testing, a remote and on-demand app testing company helping top app teams deliver high-quality software and get good app store ratings anywhere in the world. She has 5 years of experience as a marketer, spearheading lead generation campaigns and events that propel top-notch brand performance. Handling marketing of various brands, Emily has also developed a great pulse in creating fresh and engaging content. She’s written for great websites like Airdroid and SME News. You can find her on LinkedIn.