E-commerce valuation: Measure your online business worth

Posted on

Whether you’re looking to sell your online business, or simply to gauge how much it’s worth, e-commerce valuation is a useful process that’s not always intuitive.

That’s why this article is going to take you through the steps and workflows associated with the task.

We’ll also discuss the reasons why you’d need to conduct a valuation in the first place, as well as covering the factors to take into consideration to help you start off on the right foot.

Importance of business valuation

E-commerce valuation lets you gauge the rate at which your online-based company has grown.

That’s particularly useful if you’re new to the world of e-commerce business, or if you’re looking to grow in the near future–in which case you’ll also benefit from financial technology like Paymes by PayTabs, which helps you get into the e-commerce world more quickly and easily.

Image sourced from PayTabs.com

Business valuation is also crucial when you’re selling your company. It’s difficult to secure buyers without proof that your company is highly valuable, after all.

By conducting regular or semi-regular business valuations, you can ensure your company is still growing at acceptable rates. You can also compare its estimated growth with its actual growth, which helps you create more accurate estimates in the future.

E-commerce business valuation methods

In order to work out what your business’ total value is, you must first determine what your earnings are, as these make up a major factor in the overall figure. To that end, you can use the following methods.

SDE method

SDE, or Seller’s Discretionary Earnings, emphasizes the importance of your company’s cash flow history. It can be calculated as follows:

SDE = Revenue – Cost of Goods Sold – Operating Expenses + Owner Compensation

As it’s a very straightforward formula and approach, the SDE method is popular among businesses that don’t have specific accounting skills.

EBIDTA method

Short for Earnings Before Interests and Depreciation and Amortization, the EBITDA method determines your e-commerce store’s overall profitability instead of focusing exclusively on its actual profits in a given year.

That’s why EBITDA is more accurate, on the whole.

Mature businesses that aren’t going through sudden growth jumps tend to prefer EBITDA for this reason.

Free to use image sourced from Unsplash

DCF analysis

Another popular method is DCF (Discounted Cash Flow) analysis. This focuses on the future, and on extrapolating based on current facts rather than historical ones.

DCF analysis calculates the future worth of a company based on how long it will most likely take before that business starts seeing ROI on the products they sell. Alternatively, it can consider the length of time it will take before companies get ROI on their customers.

Revenue and growth valuation

This approach is great for e-commerce businesses that focus on rapid, large-scale growth, including startups and other high-value new e-commerce companies.

Obtaining your values in this method is quite simple. All you need to do is set a fixed period, usually a year, and look at the total revenue your company earned in that time. We’ll be taking that number and applying a multiplier to it shortly; this is the earnings multiple.

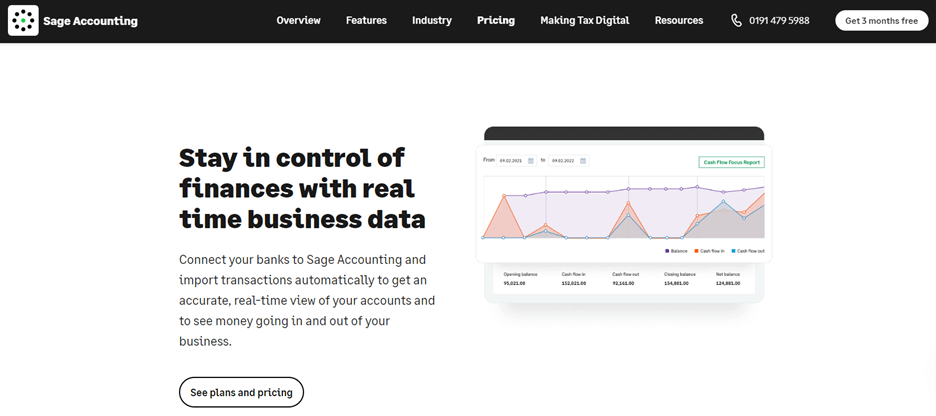

To easily access the data you’ll need for this valuation, you can use specifically designed accounting software for online sellers. This can track and monitor your financial information so you’ll always have access to the necessary data.

Screenshot taken from sage.com

Critical drivers when valuing an e-commerce business

Since a valuation is meant to give an overview of the business’ value as a whole, it has to take a lot of key variables into account.

Here’s a quick overview of some of the other biggest factors to consider.

Business age

How long has your company existed for? If it’s very young, you may have a harder time proving that any financial success it’s enjoyed can be replicated going forward, which negatively affects its value. On the other hand, an older business will have a provable record of surviving difficult times, which improves its overall value.

Financial health and records

Are your records, especially your financial ones, well-organized and easy to use? Anyone auditing your business should be able to find what they need in a matter of minutes. Otherwise, you risk sounding like your valuation is not based on facts.

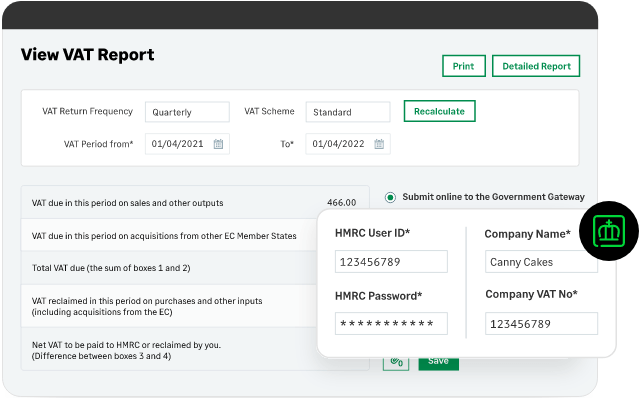

If you’re a UK business owner, getting a headstart on the HMRC’s Making Tax Digital (MTD) scheme will keep your records organized and up-to-date. Even if you’re not based in the UK, adopting a digital approach to your taxes and financial records will keep them streamlined and make backing up your valuation that much easier.

It will also demonstrate to any prospective buyers that you’re ready to handle any new developments quickly and effectively. These could be developments like MTD in the UK or the Federal Decree Law No. 47 that has recently been passed in the UAE.

Image sourced from sage.com

Revenue concentration

Does all of your income originate from a single source, or are your sources of revenue more diversified? Do you trade internationally, or is your business focused on dealing with local clients?

A company with high revenue concentration is less likely to sell well, as this creates more liabilities and makes it harder to deal with unpredictable factors in the future (or unprecedented events like the global pandemic).

RRC rate (Refund, Returns, Chargebacks)

Does your company take a hands-off approach to customer relationships, or do you put in active work to educate customers and nurture them? If it’s the latter, you’re likely to see fewer RRCs, since customers will only make educated choices about purchases and are therefore more likely to keep the items they buy.

Website

E-commerce sites can only be profitable when enough people visit them. This is why the levels of traffic your online store sees factor into its earnings multiple. This is because a store that already has high traffic levels as a result of excellent website design has greater value to a prospective buyer.

The takeaway

E-commerce valuation can be difficult, but it’s a very useful process to know how to carry out. When you’re able to value your business accurately, you’ll have a clear indicator of how much it’s worth, and how much it’s grown over the years.

Also, a valuation lets you see your business’ worth in the context of its industry, age, and practices. This helps you get a realistic idea of the total worth of your business whether you’re based in Europe, Middle East, or America.

Bio:

Sage is the global market leader for technology that exists to knock down barriers so everyone can thrive. Millions of small and mid-sized businesses, our partners, and accountants trust our finance, HR, and payroll software to make work and money flow. We digitise business processes, strengthening relationships between SMBs and customers, suppliers, employees, banks, and governments. Knocking down barriers also means we use our time, technology, and experience to support digital inequality, economic inequality, and the climate crisis.

Sage is the global market leader for technology that exists to knock down barriers so everyone can thrive. Millions of small and mid-sized businesses, our partners, and accountants trust our finance, HR, and payroll software to make work and money flow. We digitise business processes, strengthening relationships between SMBs and customers, suppliers, employees, banks, and governments. Knocking down barriers also means we use our time, technology, and experience to support digital inequality, economic inequality, and the climate crisis.