mada Debit Cards: Accepted via PayTabs

PayTabs payment gateway fully supports mada debit cards for transactions on merchant portals, e-stores, and websites in the Kingdom of Saudi Arabia.

What is mada?

mada card is a debit card issued by the local banks in Saudi Arabia, and it allows a cardholder to access funds in their accounts and it works in the same manner as regular ATM cards. mada debit cards allow cardholders to carry out online transactions such as shopping and paying government fees and utility bills. Online payment processing is safe and easy with mada.

Read More

Important!

Merchants are kindly requested to download and follow the attached mada branding guidelines with reference to mada logo placements on their respective websites.

Benefits of accepting mada through PayTabs

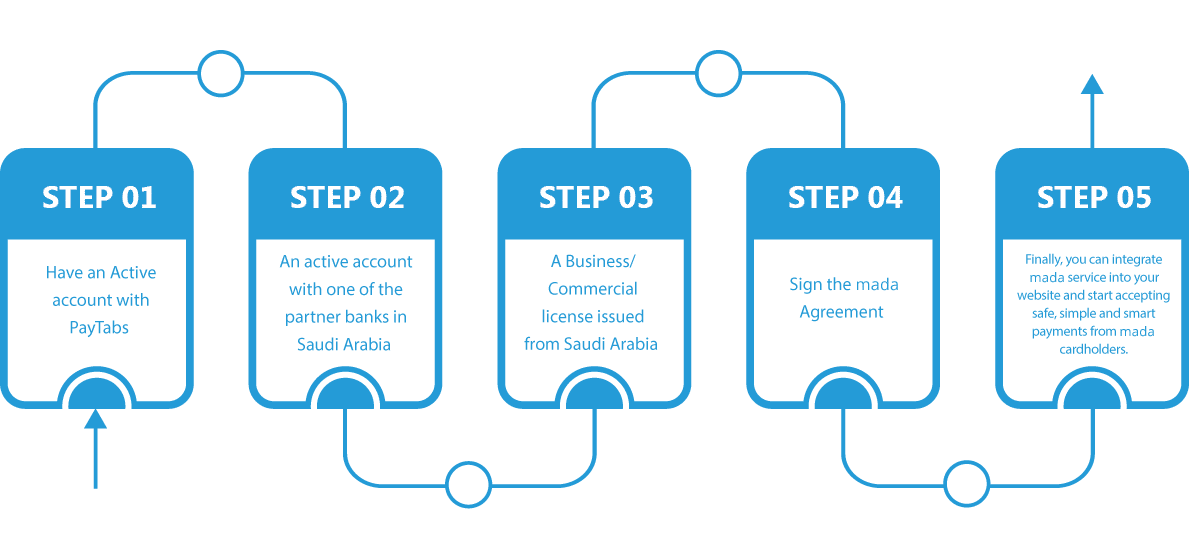

Onboarding Process

FAQs

1. What is mada all about?

mada is the next-gen electronic payment system in the Kingdom of Saudi Arabia, and involves the use of a special debit card with advanced security features that can be used to withdraw money from ATMs, pay for goods and services at physical stores, and make online payments too. mada connects all POS terminals and ATMs all over the country to a central payment switch. This switch re-routes all financial transactions that take place between a merchant’s bank and the bank that issues the mada debit card. mada has partnered with MasterCard to make both local and global online payments fast, seamless and safe.

2. How does a mada card work?

A mada debit card is like any other regular debit card and these are issued by local banks in the KSA. With this card, a mada cardholder can draw funds from their accounts, shop online, pay at physical stores in a cashless manner, and also pay government fees and utility bills online.

3. Does a mada card work only locally?

No, a mada card can be used globally too. mada has connected with other leading payment systems like MasterCard, VISA, GCC Net and American Express so that the cardholders can make online overseas transactions too.

4. Do mada cards have any new features?

Yes, mada cards now come with many advanced features such as:

- Daily transaction limit at POS terminals has now increased and ranges from SAR 20, 000 to SAR 60, 000.

- It is now very convenient to make the most of Naqd service with mada, and withdraw cash of up to SAR 400 from merchant cash supply outlets. In this process, the cash amount you wish to withdraw will be deducted from your bank account directly, along with the amount that you have to pay for the goods you purchased. This way, you won’t need to visit the ATM anymore.

- With mada cards, offline and online transactions will become very fast, easy and efficient. mada has made the electronic payment network 7 times more powerful than before.

- mada cards can be used widely and for different purposes, and by anyone who is a citizen of KSA.

- When a cardholder transacts with mada card or draws money from ATMs, he or she will receive SMS notifications instantly. So, keeping track of expenditures will be easy this way.

5. How to acquire a new mada Card?

You can request your local bank in KSA to issue you a new card if you don’t have a SPAN card currently, or you can request them to replace your existing SPAN card with a new mada card.

6. Are mada cards provided at extra charges?

No, you don’t need to pay anything extra to receive your mada card. You will either get it for free when you open a new account with a local bank in KSA, or you will get it for free when your existing SPAN card is being replaced. Renewing mada cards is also free of charge. This is as per the rules and regulations of SAMA (Saudi Arabian Monetary Authority).

7. How can merchants or businesses benefit from mada?

mada offers multiple benefits to both online and offline businesses, such as:

- Daily purchase limit with mada cards is now SAR 60,000, which can boost revenue figures for merchants.

- Physical stores will no longer need to waste time or energy in counting notes, checking their genuineness, or handling small changes, which happens in cash transactions.

- In cash transactions, collecting, transporting and depositing cash in banks on a daily basis in risky and cumbersome. mada cards will reduce this issue significantly.

- Processes like bookkeeping and accounting for daily inventories and revenues have many errors when done manually. mada can limit that risk.

- Merchants can track daily sales transactions and revenues in a better way by accepting mada as payment. This is because they will receive regular statements from their banks.

- As the number of mada cardholders is increasing every day, merchants can benefit immensely by accepting it as primary payment mode, since sales volumes will shoot up.

- Transactions are very safe, fast and convenient with mada cards and merchants can attract more customers this way.