How technology is changing our shopping experience

With growing customer expectation, e-commerce retailers are being forced to constantly innovate and raise the bar. Further, with shopping enabled through the digital platform, without the boundaries of time and place, merchants need to ensure that the customer engagement channels are continuously open. We shall now study how technology is changing the rules of the game and redefining customer experience.

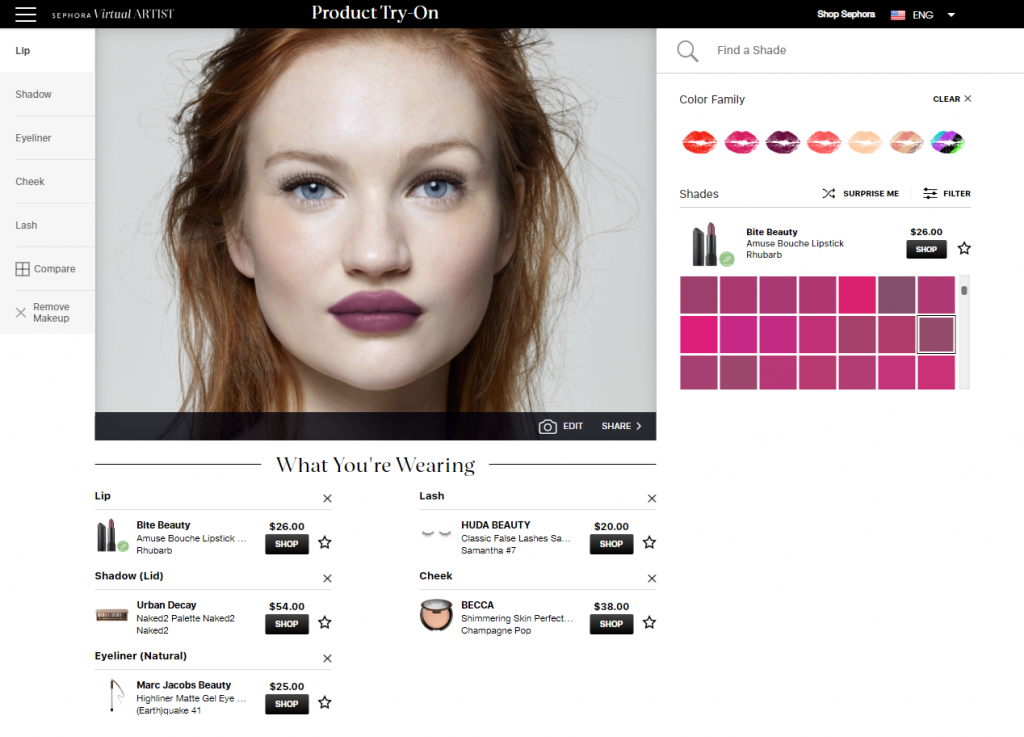

- Anytime shopping: Today’s online shopping is all about convenience. The customer can log on to an e-commerce portal, browse and compare product specifications and pricing, and even virtually try on clothes. They can add items to the cart, make the payment through the payment gateway and check out. All this is achieved within minutes, from the comfort of one’s home. The entire shopping process from start to end i.e. researching the product till the final purchase is possible digitally any time of the day or night and can be concluded swiftly.

- Smart devices for smart choices: The modern customer leverages upon cutting-edge technology to make sound purchase decisions. Often, e-commerce sites have subscription services whereby the items are delivered to the customer’s residence on a regular basis without any reminder by the customer.

- Real-time, uninterrupted support: The merchants need to constantly stay connected with the customers even post sale. This is vital in order to ensure returning customers. This can be achieved with chatbots that would readily answer customers’ queries and enhance their satisfaction.

- AI to derive insights: AI can be used to analyse customer spending patterns, study outliers and derive business intelligence. This can be applied to improve service levels and provide customized options, based on the unique needs of each customer. This would ensure lower chances of sales returns. A Gartner study estimates that by 2020, 85% of customer interactions would be handled by AI.

- Smooth payment process: Imagine you finished shopping at a huge mall and had to spend a lot of time searching for the payment counter! Frustrating isn’t it? The situation is similar to a customer entering the e-commerce portal. The customer should be able to easily navigate through the website to the payment gateway, complete the transaction and check out in minimum time. The payment gateway should be integrated with the website. Being directed to an external website for payment is a big put off for the customer and can cause cart abandonment. Further, there should be a choice of multiple payment options with personalised suggestions to opt for saved cards. In the e-commerce business, every click counts!

- Secure payment processor: This is not a feature anymore, rather an absolute necessity. The online payment platform must maintain confidentiality of customer information and card details. This is reconfirmed by adherence to global security standards like PCI DSS V3.2 Service Provider Certified.

- Customer reviews and loyalty programs: With fierce competition in the online shopping space, it is vital that merchants enhance customers’ shopping experience. For example, a product could have reviews of happy customers who have used it. This would help the hesitant customer make up his or her mind. One could also ensure that the product return process is simple and clearly mentioned. To win customer loyalty, merchants could include shopping points that could be redeemed as a discount on the price or a free product of the customer’s choice.

- Intuitive website: An interactive website with a seamless shopping experience can go a long way in higher sales conversions and customer retention. The webpage as a pop-up could guide the customer as to the further steps till the final checkout. This would facilitate the customer to stay within the website and not move to the website of a competitor. The chances of a sales conversion become higher, the longer an e-commerce portal is able to retain and keep the customer engaged within its webpages.

- Knowledge bytes: A customer who has complete know-how of the product would be in a better position to appreciate its value proposition and quality. Thus, the chances of achieving a sales transaction is better in case of an informed customer. Merchants can include a knowledge centre page within the website to enhance the shopping experience. All the information about a product and its utility should be available at a customer’s fingertips.

Technology is fast rewriting the shopping experience. Thus, merchants need to keep an ear to the ground and provide e-commerce solutions as per evolving customer requirements and technologies.