Should You Use Chatbots for Your Small Business?

Automation is the way ahead, and businesses are beginning to realize that. One way or the other, companies are trying to automate as much as possible, thus minimizing the need of human intervention. So far, it has worked well. But while the big players reap the benefits of chatbots, can small businesses enjoy some of it too?

The answer is yes. Chatbots are not grand mechanisms suitable only for big conglomerates. Innovative yet simple, even a random blogger could use chatbots to be more efficient.

Analyzing the benefits

Here is how chatbots can improve things for small businesses:

1) Improving the reach

With chatbots, you can be there for your customers 24×7. Chatbots ensure that nothing, from interaction to complaints, go unnoticed. The interactivity goes a long way in growing the reach of your business and thus, the overall growth.

2) Simple to use

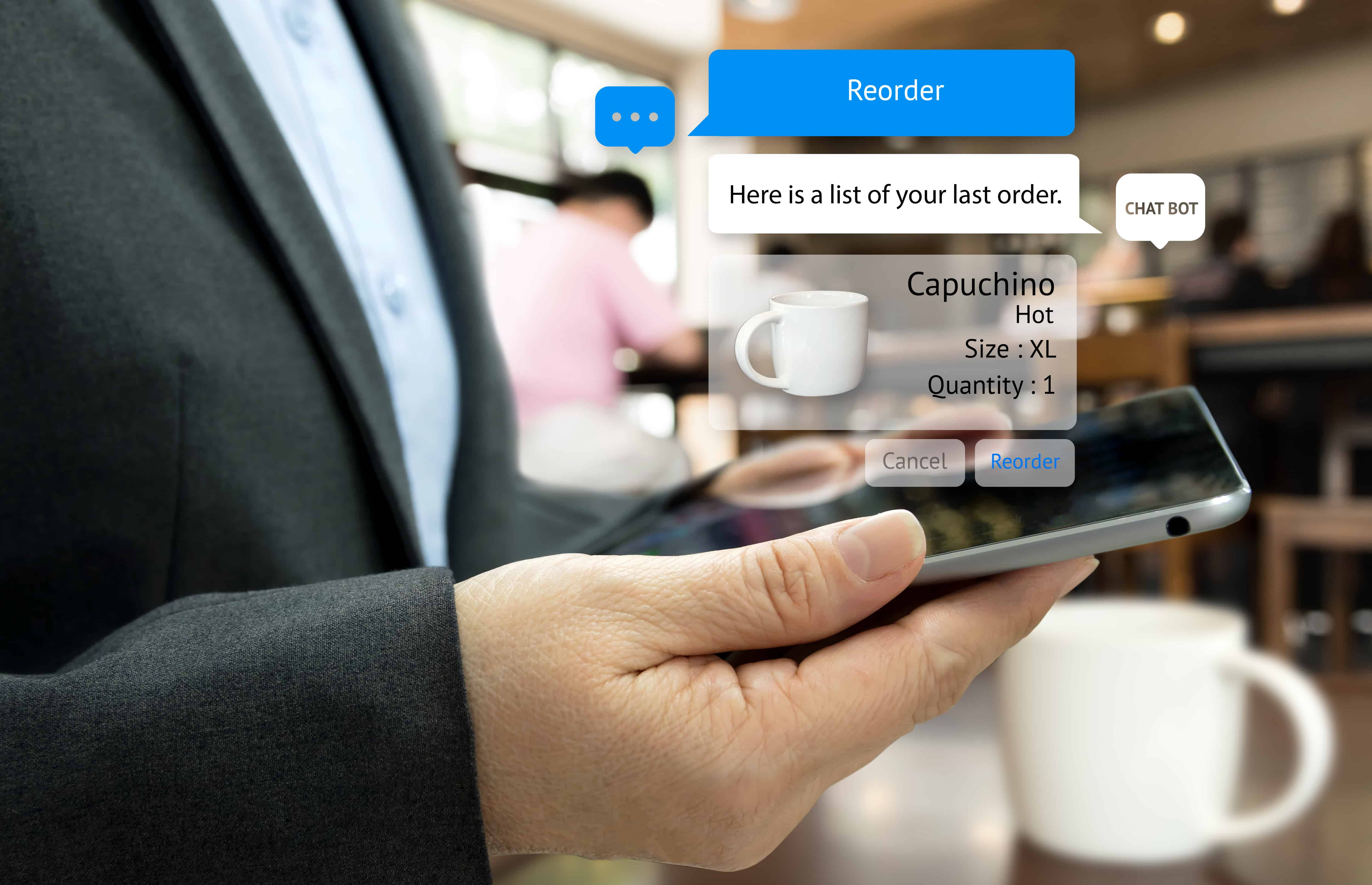

Many innovative ideas came and went without making a mark. The reason chatbots stuck was their sheer simplicity. Understanding chatbots is something that even the most non-technical person could do. While it is no big deal for a business-owner, it is an even smaller deal for the customers. In other words, using a chatbot is far simpler than many other ways of interacting with a business, which is why chatbots are fast gaining popularity among users.

3) Cheaper than you guessed

Once you get a chatbot, everything else is free of cost. Chatbots do not need lunch breaks, vacations or weekends. After the initial investment, you can have chatbots working 24×7 without worrying about their salary. Compared to humans, it is both more effective and cost-efficient.

4) Customizable

When we hear the word “bots”, we imagine pre-programmed robot texts that are boring at best. However, the new-age chatbots are anything but boring. Highly customizable, chatbots could be tailored to suit the specific needs of your customers. You have to program all the responses, of course. But from the user’s perspective, chatbots appear like cool agents who have a quirky response to everything.

Few things to consider

Chatbots are great, of course. But that doesn’t mean they are the solution to all your problems. There are some reasons why chatbots may not be the best solution for your business. Here are some:

1) Alienation from the customers

One of the biggest (and perhaps rightful) concerns small businesses have is getting alienated from their customers. Chatbots are great for programmed responses, but even the Machine Learning-powered chatbots could not hope to compete with the level of personal touch human interaction provides.

2) Not everyone’s cup of tea

One thing to keep in mind is that chatbots work best with B2C businesses, where template answers to predictable questions get the job done. However, in B2B companies where complaints are raised only in serious situations, chatbots are largely ineffective. Thus, big or small, the type of business largely defines the need of chatbots.

3) Skewed demographics

As a business owner, you would prefer your audience to be diverse (until and unless you are extremely niche-specific). However, chatbots have been found to be the opposite of diversity. Majority of chatbot users are teenagers, while an overwhelming majority are Americans. Restricting your audience to a single country and age group is not the most desirable outcome you might have hoped.

Conclusion

So, chatbots are not meant for everyone. But, for the large part, they are agents of innovation and effective in most cases. Especially if you are a B2C business that needs to be in touch with your customers at all times, nothing beats chatbots. In the coming years, we will see a growing use of automated tools for customer interaction. It is your chance to be part of the future, now.